2025 Annual Review

A very strong year with performance largely driven by events rather than general market sentiment.

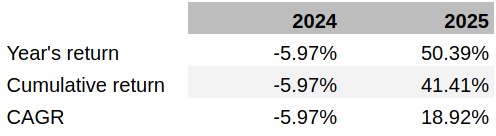

Portfolio returns

I've been publicly documenting all my portfolio moves for a couple of years now, so I think it's time I provided a review of how my portfolio has performed. This is something I plan to do each year as an "annual review", wherein I'll provide an update on my cumulative performance to that point, along with some discussion of the key drivers in the past year, and the current portfolio composition.

As you can see from the table below, 2025 has been a very good year with a return of 50.39%, markedly better than the -5.97% decrease seen in 2024. The cumulative return since inception now stands at 41.41% with a compound annual growth rate of 18.92%.

I'm obviously very pleased with this result and hope to be able to continue increasing the cumulative return and CAGR in 2026.

Newsletter performance

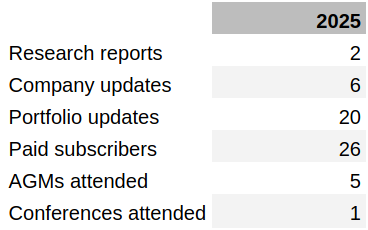

I'd also like to give you an update on how my newsletter has been doing.

During 2025, I published two new research reports on Jet2 (JET2) and James Latham (LTHM); six company updates on Aviva (AV), Warner Bros. Discovery (WBD), Ecora Resources (ECOR), Fuller, Smith & Turner (FSTA), tinyBuild (TBLD) and Secure Trust Bank (STB); and twenty portfolio updates.

I was able to attend five AGMs during the year (ECOR, STB, FSTA, LTHM and SHEP), and one investment conference (Mello2025). Unfortunately, TBLD clashed with the conference and JET2 clashed with a visit from my in-laws, so I wasn't able to attend either of their AGMs this year. As much larger companies, with regularly published analyst calls and very detailed reports, attending the AGMs of AV and WBD is less crucial. I did attend Aviva's AGM in 2024, however, as that year it was held pretty close to where I live.

It's been a good year for subscriber growth, with the number of paid subscribers reaching 26 at the year-end, having started the year at 9.

I'm sure you'll be reassured to know that, even with a relatively modest portfolio, my investment returns were more than 22x my subscription revenue and probably closer to 50x once you factor in tax, which I have yet to pay. The subscription revenue has gone a long way towards covering my travel and other newsletter-related expenses, however, so it is certainly very valuable.

It would be remiss of me not to thank my paid subscribers at this point, whom I hope to continue to provide good value for money in 2026.

If you'd like to see my current holdings along with a breakdown of the key contributors to my 2025 performance, please consider becoming a paid subscriber.

I'm currently running a very limited time offer on an annual subscription allowing you to secure a 28% discount on the first year, bringing the price down to £72 (equivalent to £6 per month). To redeem this offer, simply click the button below.