Company Updates - ECOR

Highlights from Ecora Resources' Q4 trading update and FY24 outlook.

Ecora Resources

On Wednesday (31 Jan), Ecora Resources published their Q4 trading update. Here are the highlights:

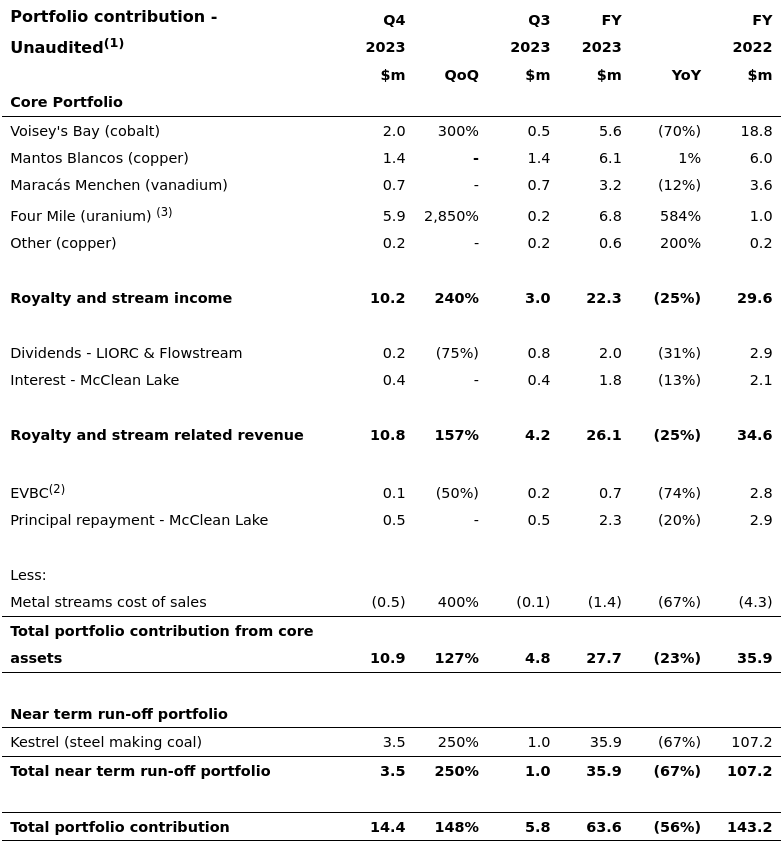

- Total portfolio contribution for FY23 was $63.6m (FY22: $143.2m), with the contribution from Q4 coming to $14.4m, up from $5.8m in Q3.

- The very large increase in revenue from Four Mile includes $5.4m of accrued income released to the income statement following the favourable judgment announced in December. This is non-recurring and doesn't involve any further cash payments.

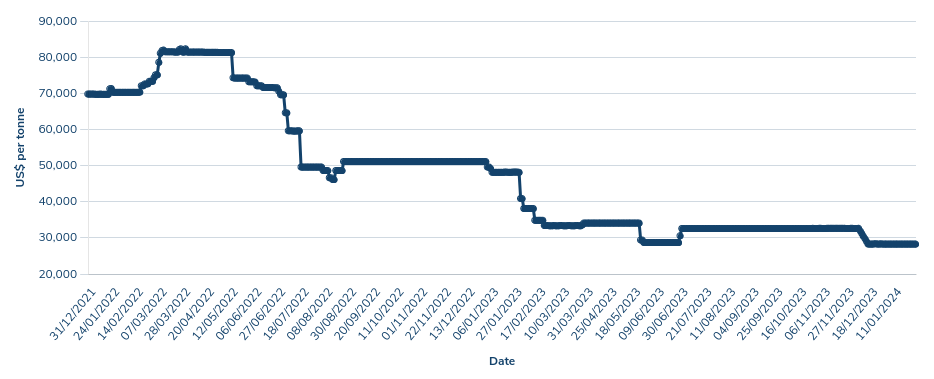

- Revenue from the Voisey's Bay cobalt stream increased markedly due to 4 deliveries being made in Q4, versus 1 in Q3. For the full year, deliveries totalled 11, down from 19 in FY22. The year-over-year decrease in revenue was further exaggerated by a c.50% drop in the average cobalt price between 2022 and 2023.

- Voisey's Bay production should ramp up during FY24, with the anticipation of between 12-16 deliveries during the year. 5-6 of these are expected in H1, and the number of deliveries in H2 will depend on the rate of progress with the underground mining transition. The cobalt price has hopefully hit a floor at around its pre-pandemic level, allowing us to project out modest revenue growth in FY24 on the basis of these delivery estimates ($6-8m from 12-16 deliveries).

- Mantos Blancos production volumes are also forecast to increase in FY24, due to higher mill throughput. An increase on the $6.1m generated in FY23 could therefore be on the cards if copper prices hold up.

- Following production moving back into Ecora's private royalty area at the end of 2023, saleable volumes from Kestrel are forecast to be 15-25% higher in 2024 than in 2023. This will be weighted towards Q1 and Q4, with c.75% and c.15% being produced in the respective quarters.

- Ecora has invested a further $7.5m into Brazilian Nickel's Piaui nickel-cobalt project in return for an additional 0.35% royalty, bringing their total to 1.60%. They retain the right to acquire a further 2.65% for $62.5m.

- The above acquisition was funded with the proceeds from the sale of c.60% of Ecora's residual stake in LIORC, which generated CAD$18.9m with a healthy CAD$4.1m gain on disposal.

- Net debt at the end of the period was $75m (2022: $36m), and post period end they refinanced their revolving credit facility, extending its maturity out to January 2027 at an interest rate of SOFR plus 2.25-4.00%, depending on leverage levels. The base capacity of the facility remains $150m, with a $75m accordion feature for funding future royalty acquisitions.

https://www.londonstockexchange.com/news-article/ECOR/q4-trading-update/16311106