Company Updates - STB

Fallout from Court of Appeal vehicle finance commission ruling, and Q3 trading update.

Vehicle finance commission

It has been a very eventful week for Secure Trust Bank, and the broader finance industry. A shock ruling by the Court of Appeal on Friday, 25th Oct, sent lenders and investors into a panic, as it suggested that any commission paid to dealers or brokers for selling vehicle finance not clearly disclosed to the borrower is illegal and warrants compensation.

This extends far beyond the discretionary commission arrangements under review by the FCA, and would bring pretty well all vehicle finance loans written in the last 20 plus years into the firing line.

We're already seeing the fallout, with many lenders (including STB) pausing lending or ceasing commission payments amid the uncertainty. This is in turn having a substantial impact on car dealerships and drivers, since 9/10 cars are sold on finance and dealerships rely on commissions to make a profit.

If the ruling were to stand, there would likely be an exodus of lenders, driving up finance costs for borrowers and rendering the business model for many dealerships unviable. The scale of the potential compensation claims - estimated to be £30bn plus - would severely impact lenders, leading to redundancies and a general reduction in the availability of credit across the whole economy. This would be a highly contractionary event, at a time when the government is trying to deliver growth.

It's unsurprising therefore that emergency meetings have been held throughout the week between government ministers/treasury officials, the FCA, and representatives from the Finance & Leasing Association (FLA). A possible outcome is the temporary suspension of all legal claims before an overturning of the Court of Appeal ruling by the Supreme Court.

So where does this leave STB? Vehicle finance lending was temporarily paused during the week, while the company considered the implications of the ruling, and has now resumed.

The share price has taken a significant hit, falling 40%, and ending the week at £4.74. This was driven, at least in part, by one large investor that owned 9.9% of the company, selling down their holding to below the 5% reporting threshold, and possibly liquidating it thereafter.

With the market capitalisation now standing at £90.4m, the company trades at 0.26x tangible book value, and 3.7x last year's net profit (or 3.0x the 5-year average net profit).

I've run some numbers on the potential impact of the commission compensation claims, were they to be restricted to the discretionary commission arrangements used for a small portion of loans issued between 2009-2017.

A fairly conservative base case would be low-to-mid single digit millions in compensation, with a similar amount in associated administrative expenses, making it pretty inconsequential. Of course, were it to be extended to include all vehicle finance commission, the cost would be an order of magnitude greater.

I personally lean much more heavily towards the base case given the scale of the potential fallout, which is why I'm content to continue holding and have added modestly to my position.

It was somewhat encouraging to see the company's CFO purchase 4,094 shares at an average price of £4.86 per share on Friday (1 Nov), indicating she is of a similar mind. Hopefully we'll see some more insider purchases in the coming weeks.

Q3 trading update

We also got a Q3 trading update on Friday (1 Nov), detailing the company's performance during the quarter ending 30 Sep 2024, and providing an outlook for the full year.

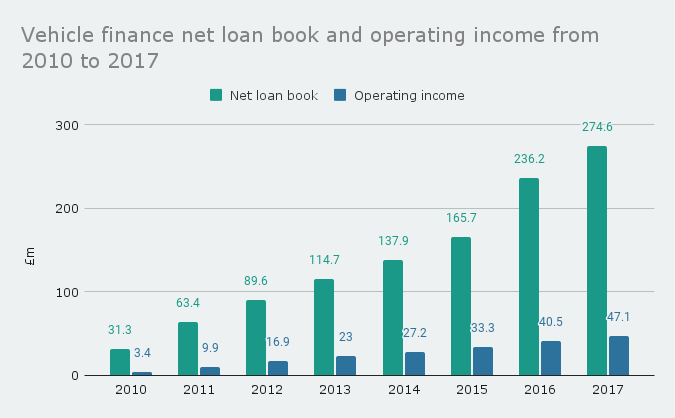

Net lending increased marginally to £3,439.2m (2Q24: £3,421.6m), as growth of 3.1% and 7.5% in the commercial and vehicle finance segments, respectively, was offset by small decreases in the retail and real estate finance segments. Notably, the vehicle finance net loan book has now passed £500m for the first time.

New business lending was £577m during Q3, the highest level this year and broadly in line with Q3 2023.

Customer deposits grew by 3.2% to £3,141.4m (2Q24: £3,042.7m), as the company continued to repay the Bank of England's TFSME funding ahead of contractual maturity next year. At the end of the quarter, a total of £105m had been repaid (c.27%), and a further £15m repayment was made in October.

Higher levels of defaults, resulting from a pausing of collections activity following the FCA's Borrowers in Financial Difficulty (BiFD) review, have led management to guide down market profit expectations for FY24 by £10m-£15m.

Since they don't disclose the market consensus figure they're using, my best guess is that their FY24 continuing profit before tax guidance translates to £30m-£35m (market consensus c.£45m). It's likely however that at least some of this value will be recovered in 2025, as collections activity has now resumed.