Firm Returns Weekly - TBLD, Investing Approach

tinyBuild

Slime 3K

On Thursday (2 Nov), Slime 3K launched in Steam early access for $4.49, including a 10% launch discount. There was also cleverly an additional 20% discount if you owned Despot's Game, which has helped to drive up sales of the original entry in the franchise (currently selling for $8.99, including a 55% discount). tinyBuild owns the IP of both titles, so they make very healthy margins on each sale after subtracting the platform fees and sales tax.

The price point for Slime 3K is in line with comparable games within the genre such as Vampire Survivors, so there's no way they could realistically have charged any more, even if they'd wanted to.

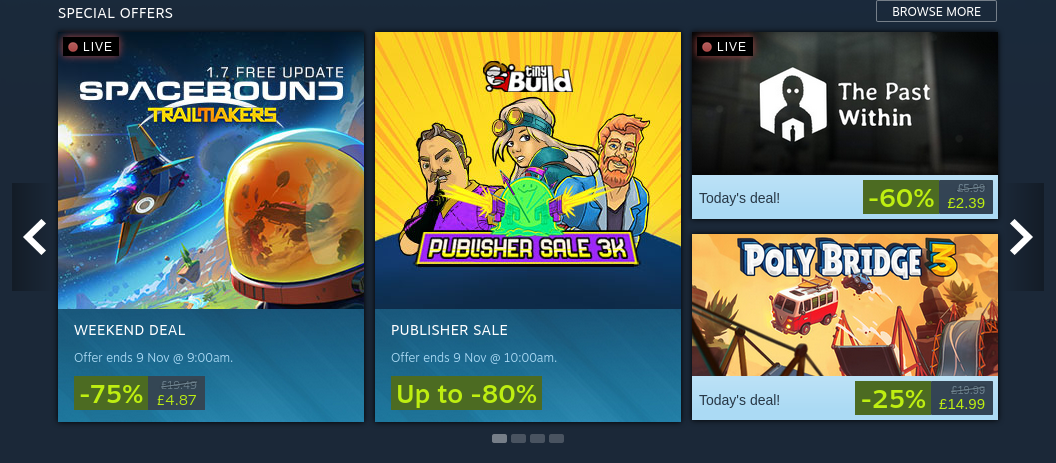

The launch also coincided with a publisher sale, featuring a dedicated sale page and appearing in the special offers section of the Steam homepage (as shown below).

tinyBuild publisher sale promoting Slime 3K launch.

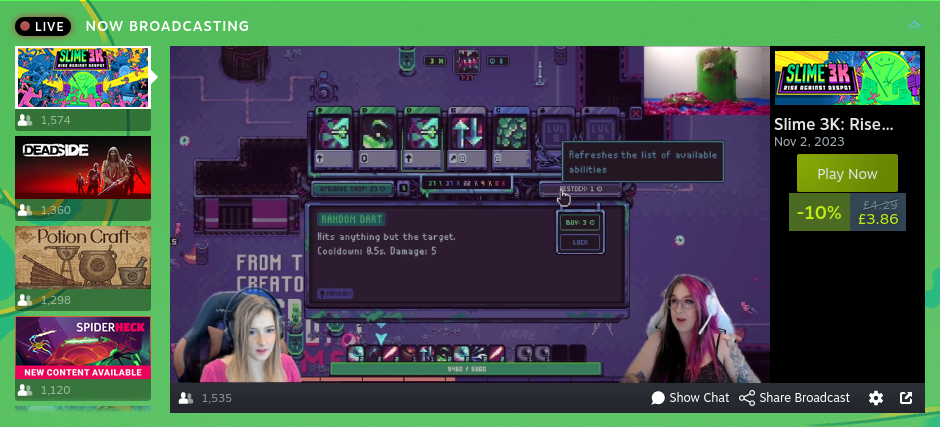

The sale runs through to 9 Nov, and there's been a pretty continuous stream of traffic to the sale page thus far - which you can see in the viewer numbers of the broadcast livestreams.

The company has also sponsored a number of influencer videos to drum up interest among their followers. Collectively they've racked up a decent number of views on YouTube in the last 24 hours.

This particular game genre has become a pretty crowded field, so it's difficult for a new entrant to stand out. The release of the demo during the Steam Next Fest certainly helped increase interest, adding 1k followers (~10k wishlists), but it's undeniable that the substantial marketing efforts we've seen post-launch have been a driving factor in early sales.

On the day of release, Slime 3K was in the top-300 selling games on Steam, getting as high as #201 one time I checked. It's since pulled back a bit, but still holding steady in the low 300's at time of writing.

Reviews have been somewhat mixed, with 65.14% out of 109 being positive at time of writing. I think the game is much more strategic than others in the genre, with a lot of weight put on deck building and inventory/shop management. Some people have found it too challenging and struggled to progress, so I expect the developers will adjust the balance accordingly to make it more accessible.

This is the advantage of releasing a title in early access: it de-risks the full cross-platform launch, and allows the developers to rebalance and tailor the game to the preferences of the players.

Concurrent player numbers have been solid, and trending up as we entered the weekend. The peak at time of writing was 687, achieved on Friday (3 Nov).

We've seen a substantial boost in sales across the entire portfolio, which is definitely going to help in meeting the company's cash flow targets for H2.

Hello Neighbor 2 - Halloween Update

This week also saw the launch of the Hello Neighbor 2 - Halloween Update on Steam. So far it has been well received by players, with the 88% of recent reviews (last 30 days) being positive.

Concurrent player numbers also saw a decent boost, though they haven't yet come close to their peak of 674 at launch.

There has been some frustration among players (most of which play on consoles) that the patch wasn't simultaneously released across all platforms. I suspect this was probably the intention, but when the 31 Oct deadline came there were still some issues with the console versions. It's not ideal, and may have lost some of the momentum built up by the marketing efforts in the preceding months, but it's definitely better than releasing buggy console versions.

The positive reception amongst PC players bodes well for the console launch when it comes.

Investing approach

I recently listened to a couple of interviews with Bill Nygren of Harris Associates that made me reflect on my own investing approach, so I thought I'd share these reflections with you.

Bill has been managing the Oakmark Select Fund since 1996, and adopts a more traditional value investing strategy of buying at 50%-60% of fair value and selling when it reaches 90%. They've found this process takes 5 years on average, so they typically invest with a 5-7 year time horizon.

I'm definitely aligned with this approach of buying below a threshold 2/3 of fair value, and preferably below 1/2. Depending on the company however, I do think I'd be prepared to let it run a little if the stock got ahead of the fundamentals. For example, I'd probably assign a fair value to tinyBuild somewhere around the £1 per share mark, but assuming it got there in the next year or two, I'm unlikely to sell the shares because I see realistic scenarios where it could go far higher. I don't know exactly where my level is, but maybe somewhere around £2 per share I'd look to trim my position.

The 5 year average is very interesting. I hadn't really put a minimum holding period on my investments before, but will be adopting 5 years from now on. So long as nothing is irreparably broken with my investment thesis, I will wait for this holding period to elapse before considering selling. The question is: what would break my investment thesis? Maybe I'll leave that for another post.

"Fair value" is often a moving goalpost, as the Oakmark funds own companies expected to grow their fair value over time, resulting in returns that exceed those of closing the discount alone. This can also mean that they end up holding companies for longer than just 5-7 years, as by the time the share price reaches 90% of their original estimate, the fair value has grown. Crucially though, they are very strict on selling a position once it reaches 90%.

As I outlined above, I'd be prepared to continue holding a company if it reached its fair value prematurely, provided there was the prospect of significant growth from that point.

The other key takeaway for me here is to try and own companies that are likely to grow their fair value over time. A good yardstick is: "Will this business be worth more in 5 years from now?". If you don't apply this rule, you're at risk of the discount closing due to a movement in the fair value rather than the share price!

Having said that, there are exceptions in cases where the management of a (potentially) declining business has clear policies of returning capital to shareholders through dividends and share buybacks.

When it comes to calculating fair value, the models used by analysts at Harris Associates limit forecasts of earnings per share growth to 7 years (their investing time horizon), with emphasis on the first 2. Anything beyond this they deem too unreliable to be factored into the valuation.

While I don't think a model really helps with determining the suitability of an investment (anything that depends on the accuracy of a model is not cheap enough!), I do see the value in forecasting out the full financials for the next couple of years as part of your ongoing due diligence. This is because it allows you to more closely monitor the company's performance, and compare it with your expectations.

The only issue is the time it takes! Realisitcally, I don't sufficient time available to make and update detailed models for each of my holdings, so I'll have to keep any modelling to a more limited level. The good news is that I don't believe it's necessary for investment success.

I hope you've found these reflections interesting. Do let me know if you want to hear more of them in future.