Three Contrarian Investment Ideas for January 2026

Today I'm sharing three interesting companies I've been researching over the last few weeks. All three are going through some manner of turbulence that has hit their share price, but in each case, the impact looks relatively short-term and thus presents a potential opening for contrarian value investors to exploit.

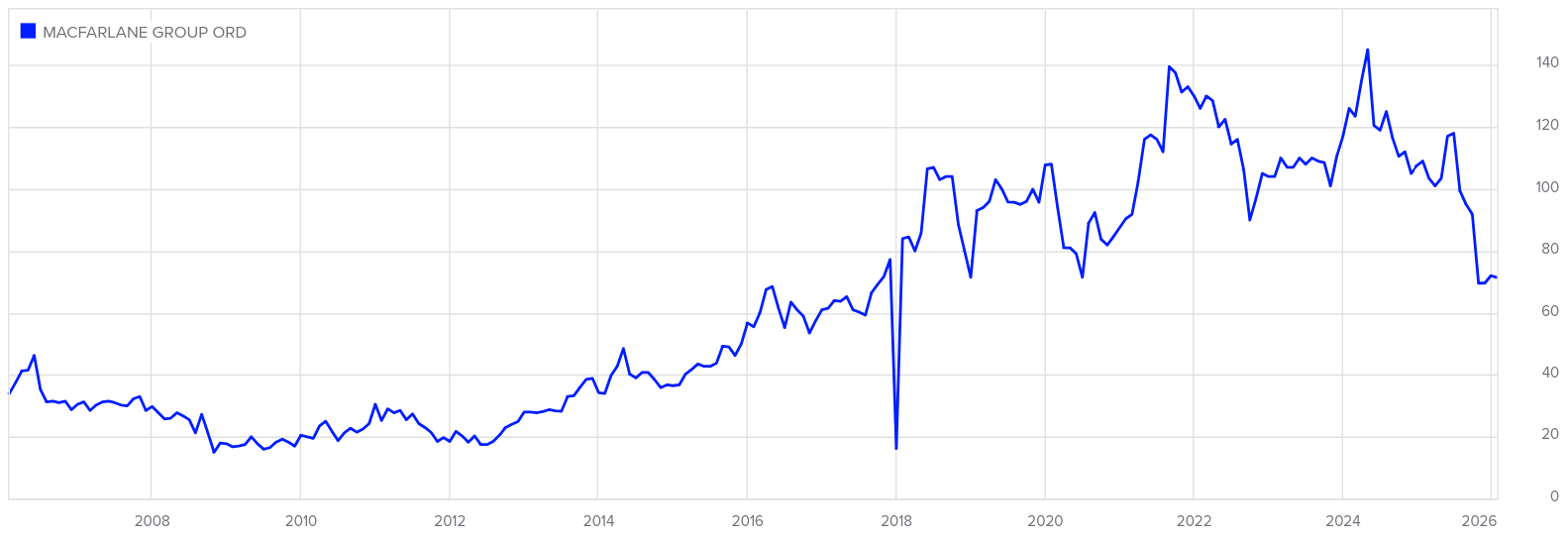

MacFarlane Group (MACF)

Share price: £0.714

Market capitalisation: £110.03m

MacFarlane Group is a vertically integrated manufacturer and distributor of packaging headquartered in Glasgow, with operations throughout the United Kingdom and recently expanding into parts of Europe. Its products span every category, from cardboard packaging used for e-commerce, to specialist foam used for transporting aerospace components.

The company has a long track record of growth, both organically, and through an average of 1-2 complementary acquisitions each year, made possible by the highly fragmented and diverse nature of the protective packaging market. In fact, 2024 was the company's 15th consecutive year of growth in profit before tax.

Recent expansion into Europe has been driven by requests from existing international customers who wish to have a consistent supplier of protective packaging across all the regions in which they operate. Being demand-led significantly reduces the risk of entering these new markets, and the expansion has been largely facilitated by the acquisition of established local companies rather than building new businesses from scratch.

So where's the turbulence you might ask? Firstly, the general economic slowdown in the UK, impacting customer demand, combined with (and in part due to) increased employment costs, linked to rises in employers National Insurance contributions and the National Minimum Wage, have squeezed the company's margins. Secondly, a fatal accident at a significant and recently acquired subsidiary in H2 2025, resulting in the temporary halting of its operations. These two factors together decreased the profit outlook for 2025 and the share price responded accordingly.

Given the historic track record, it seems highly likely to me that the business will survive these near-term headwinds and return to growth in the medium-term. Leverage has increased following the subsidiary acquisition, but remains sustainable at a little over 1x EBITDA (excluding lease liabilities), with interest well covered.

Using the 2024 results, which, while likely higher than 2025, are probably closer to a normalised level, the shares trade with an earnings yield of 14.1%. The company also pays a progressive dividend, providing a yield of 5.1% on the current share price.

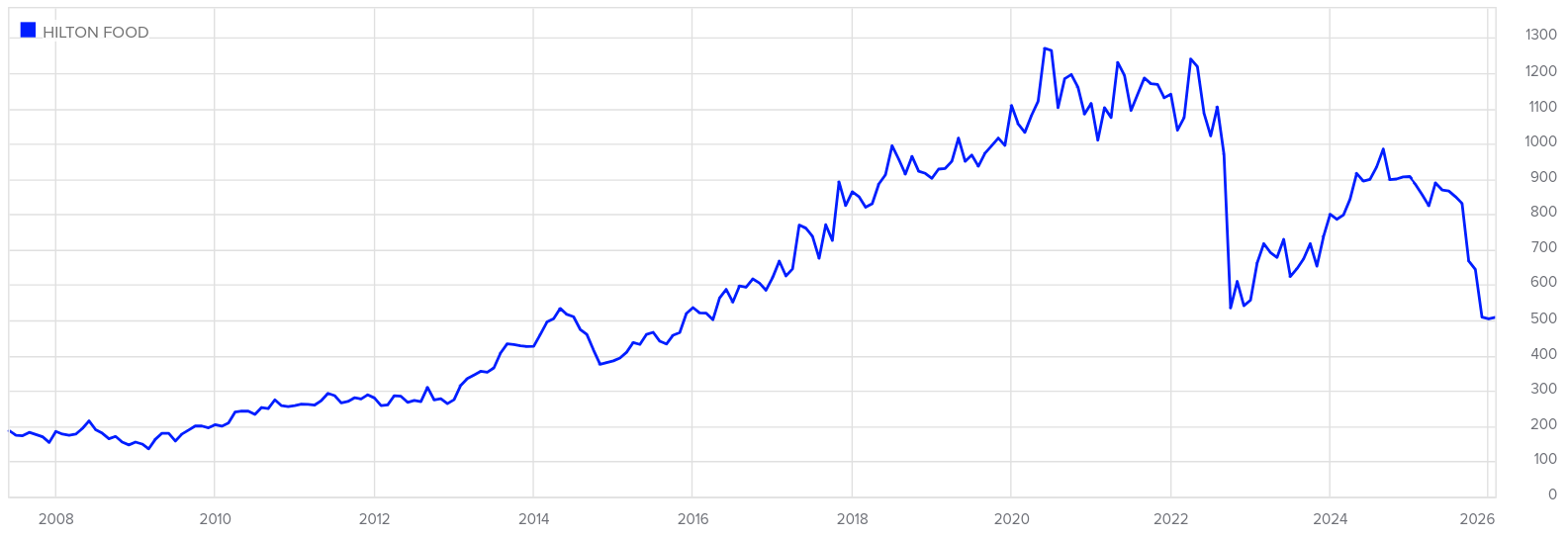

Hilton Food Group (HFG)

Share price: £5.08

Market capitalisation: £459.67m

Hilton Food Group processes, packages and distributes food - primarily meat and fish - to retailers globally. The company was founded in 1994 in Huntingdon, UK, where it still has its head office today, and listed on the London Stock Exchange in 2007.

Like MacFarlane, it also has a long track record of growth, both organic and inorganic, and in 2024, generated revenue of just under £4bn and net profit of £41.6m, compared with revenue of £1.1bn and net profit of £21.5m in 2015.

Today it's revenue is split between the United Kingdom (c.£1.5bn), Asia Pacific (c.£1.5bn) and Europe (c.£1bn), with a portion of revenue from some regions being attributable to exports (e.g. salmon from Europe to the United States). Counted among its customers are some very large blue-chip retailers, including, Tesco in the UK, Woolworths in Australia and Costco in the US.

The company is in the process of setting up new operations in Canada and Saudi Arabia, in both cases with a local partner: Walmart in Canada and NADEC in Saudi Arabia. These projects have required significant investment, but are scheduled to begin operations in 2026, and start contributing to group profits in 2027, with returns on capital employed above the company's hurdle rate of 20%.

The headwinds that have hit the company and its share price have been two-fold: 1) food inflation - 30% for beef and 60% for white fish in the last year - which has impacted demand for certain products 2) the detection of low levels of listeria bacteria in some shipments of salmon to the US from the company's processing facilities in Greece, forcing them to shift production to the Netherlands pending regulatory approval from the FDA. This approval was delayed by US government shutdowns during 2025, and as a result, required the company to maintain this sub-optimal supply arrangement for most of the year, at significant cost. The other factor you might have expected to impact the company was US tariffs, but apparently these have been passed on to customers with no change in demand.

Net debt grew in the first half of 2025, as the company ramped up investment in its Canadian development and made the decision to tactically increase inventory ahead of the Christmas period to ensure stock availability. Despite the increase in net debt, leverage remained very manageable at 1.3x EBITDA with interest amply covered.

Using the 2024 results, the shares currently offer an earnings yield of 9.0%, free cash flow yield of 13.5% (calculated using total capex; 23.5% if you subtract only maintenance capex) and dividend yield of 6.9%.

Eurocell (ECEL)

Share price: £1.26

Market capitalisation: £125.65m

Eurocell is a vertically integrated manufacturer, distributor and recycler of PVC window, door and roofline products based in the United Kingdom. The company is split into two divisions: Profiles, which manufactures extruded rigid PVC profiles, sold to third-party window and door fabricators, and foam PVC products; and a Branch Network, that sells building plastics, including foam products from the profiles division, to a variety of trade buyers.

Eurocell's revenue comes from three key markets: 1) Private residential repair, maintenance and improvement (RMI), accounting for c.85%; 2) private residential new build, accounting for c.10%; and 3) commercial (RMI and new build), accounting for c.5%.

In Mar 2025, the company acquired Alunet for £29m plus up to £6m in contingent consideration, subject to EBITDA performance over the next 4 years. Alunet manufactures and distributes aluminium window and door products and premium composite doors with solid wood cores, making it highly complementary to Eurocell's existing business and expanding its offering into more premium product lines. Performance since acquisition has been strong, with Alunet providing £1.6m in adjusted operating profit to the Group from the beginning of March to 30 Jun 2025.

The current CEO, Darren Waters, launched a 5-year plan at the beginning of 2024, with the ambition to reach £500m in revenue and £50m in operating profit by the end of 2028. This is to be delivered through: the expansion of the branch network to 250 branches from 212 at 31 Dec 2024; utilisation of spare capacity across the branch network to stock and sell more windows from the branches; growing new business lines, such as extended living space products, which include garden rooms and extensions; and improving operational efficiency through organisational restructuring and investment in new trade counter and ERP systems. For reference, revenue and underlying operating profit (removing expenses related to the implementation of the strategic plan) in the year to 31 Dec 2024 were £357.9m and £22.8m, respectively.

The company has had a good track record of growing revenue since it went public in 2015 - more than doubling - but profit growth has lagged behind, with net profit remaining fairly flat at around £20m for most of those years. High levels of inflation and depressed demand have seen margins shrink in the last couple of years, causing net profit to decrease to around £10m and the share price to fall commensurately.

Cash flows have remained healthy however, and the company has been deploying them to aggressively repurchase shares. In 2024 it spent £15m on share repurchases, equating to approximately 10% of the company's market capitalisation. Another £5m was allocated for share repurchases in 2025 and management intends to continue repurchases at around this annual rate while the share price remains depressed. The company also pays a progressive dividend, with payments totalling £6.1m in 2024.

Another data point worth factoring in is a number of substantial share purchases made by Derek Mapp, the company's Non-Executive Chairman, since his appointment in 2022. At 31 Dec 2024 he held 589,417 shares and has subsequently purchased around 60k more.

The company's net debt has grown following the Alunet acquisition, but its leverage remains very sustainable at less than 1x EBITDA, with interest well covered.

Using the 2024 results, the shares currently offer an earnings yield of 8.4%, a free cash flow yield of 11.8% and dividend yield of 4.9%. There's also the buyback yield, which currently equates to around 4.0% on the basis of £5m annual spend. A recovery in earnings to their historic level of c.£20m would double the earnings yield, and achieving management's 5-year targets would take it considerably higher.

If you'd like to find out which, if any, of these companies I've added to my own portfolio and get access to all my full research reports, consider upgrading to a paid subscription.

I'm still running a New Year offer, giving you a 28% discount on an annual subscription, bringing the price down to just £72 for the first year (equivalent to £6 per month). To redeem this offer, click the button below.