Company Updates - DSW, WBD

Trading update from DSW Capital; and some WBD updates, including the sale of All3Media.

DSW Capital

Trading update

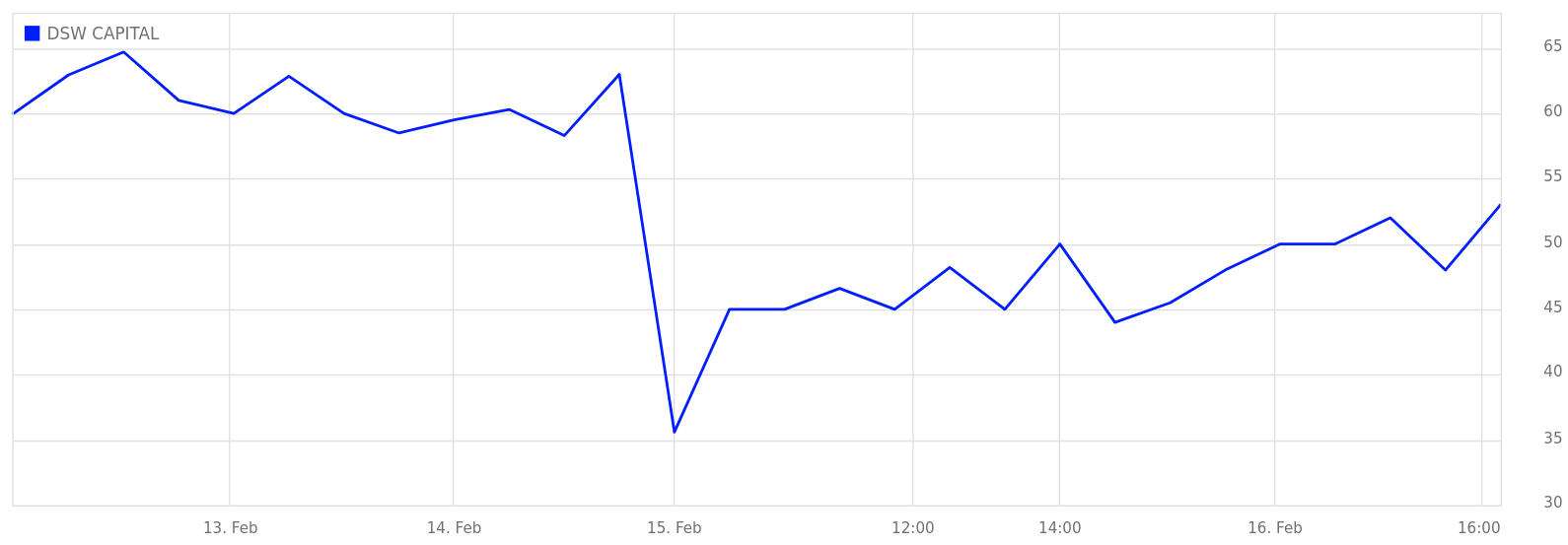

On Thursday (15 Feb), DSW Capital released a trading update covering the Group's performance in the months since the release of the half-year results, and a revised outlook for FY24 (ending 31 Mar 2024).

Unfortunately, it looks as though the improvement in M&A activity seen leading up to the end of the year has stalled, resulting in below expectation network revenue in January, and more significantly, slippage to previously anticipated deal revenue, and even some deal aborts, in February. This is expected to have a material impact on FY24 results, with adjusted pre-tax profit now guided to be £0.6m-£0.7m, compared to the November forecast of £1.1m-£1.4m.

Cash as of 31 Jan 2024 was £2.7m, following the £0.2m dividend payment made during the month. This is pretty well in line with the cash balance of £2.8m stated in the half-year results.

My prior estimates for FY24 and FY25 are obviously going to need some adjustment in light of the new profit guidance.

I've revised down expected network revenue to £11.5m from the £18m, and adjusted EBIT and free cash flow come out at £671k and £670k, respectively, which fits within the range for adjusted pre-tax profit given by management. For FY25, I've reduced my prior estimate for network revenue of £21.02m by 20%, which then flows through to the other figures.

The resultant impact of these profit downgrades on near-term valuation multiples has been offset somewhat by a fall in the company's share price, bringing its market cap down to c.£10.3m from c.£12.6m when I published my write-up.

Price to FCF for FY24E comes in at around 15.4x, and falls to 10.5x for FY25E. I don't consider this screamingly cheap given the company's size, but it's pretty reasonable for a cyclical trough. We could see a significant rebound once the M&A market recovers, bringing P/FCF down into the single digits. This would particularly be the case if they're able to continue recruiting through the current downturn.

It's worth remembering that the company and it's Directors have been through many such cycles, so I see no reason why they won't get through this one.

There were also a couple of positive notes to mention: firstly that the business recovery and tax advisory licensees acquired during FY24 have been performing well; and secondly that the company is seeing record numbers of enquiries from potential new partners and licensees. Both of these factors should help underpin a stronger outlook for FY25 despite management's more cautionary stance.

https://www.londonstockexchange.com/news-article/DSW/trading-update/16333410

Warner Bros. Discovery

All3Media sale

All3Media - the UK production company jointly owned by WBD and Liberty Global - has been sold to RedBird IMI for $1.45bn. This represents a decent premium to the $930m paid by Discovery and Liberty Global in 2014.

It seems that WBD is looking to simplify their business through the sale. At the time of initial purchase, Discovery didn't have a production business of its own, but the Warner Media merger in 2022 brought with it a very substantial production business, making the All3Media stake less relevant.

True Detective: Night Country

The fourth season of True Detective has just passed the acclaimed first season for viewership, with an average of 12.7m viewers per episode since its premier on 14 Jan, versus 11.9m for the first season.

Final viewership numbers (which are recorded 90 days after the season premier) look set to compare favourably with The White Lotus season 2 (15.5m) and Euphoria season 2 (19.5m).

https://www.thewrap.com/true-detective-night-country-season-4-ratings-hbo/

Dune: Part 2 first reactions

First reactions to Dune: Part 2 from attendees at the film's London premier last week have been very favourable, boding well for ticket sales for its box office release on 1 Mar.