Company Updates - WBD, TBLD

Highlights from WBD's Q4 and full-year earnings; and new game announcements from tinyBuild.

Warner Bros. Discovery

Q4 and full-year earnings

WBD released their Q4 and full-year results on Friday (23 Feb). Here are some highlights from the press release and earnings call:

- Free cash flow was $3.31bn in Q4 and $6.16bn for the full-year, representing increases of 33% and 86% respectively, over 2022. This included a c.$1bn benefit from strike-related decreases to production costs, which hopefully won't be repeated in 2024. There are however expected to be savings of similar magnitude from lower restructuring charges, capex, and interest expense, that should balance things out year-over-year.

- Adjusted EBITDA for the group grew 12% (pro-forma adjusted) to $10.2bn, driven largely by decreased corporate expenses and a c.$2.2bn improvement in profitability for the DTC segment - which achieved a $103m profit for the year. The studios and networks segments saw adjusted EBITDA declines of 21% and 9% respectively, as their revenues fell and expenses in the studios segment rose due to the increased theatrical release slate.

- The result of the FCF expansion and adjusted EBITDA contraction was a FCF conversion rate of around 60% - their long-term target level. It's likely that this will come down in 2024 as things normalise somewhat.

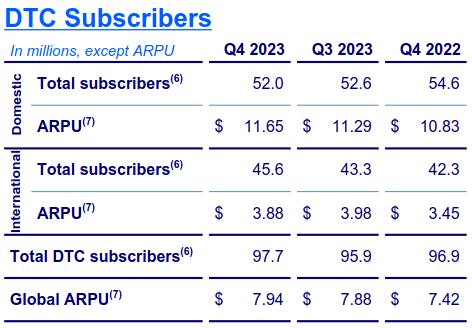

- Total DTC subscribers saw modest growth to 97.7m, including 1.3m subscribers obtained through the BluTV acquisition, and the transition of TNT Sports Chile from the networks to the DTC segment. Global ARPU also saw a modest rise to $7.94.

- Management has been keen to stress that Max is currently only available to less than half the number of potential customers compared with their larger competitors (Netflix, Disney+). So as they reposition towards profitable growth in 2024 onwards, there is plenty of room for expansion. This will begin with a rollout of Max to LatAm in Q1, then certain European markets in Q2 - including France and Belgium which are brand new markets. Asian Pacific will come in 2025, and then the rest of Europe - such as the UK and Germany - in 2026. They're still targeting $1bn in EBITDA from DTC in 2025.

- Discovery content has contributed significantly to viewership on Max, sometimes occupying as many as 5 of the top-10 shows. This has helped bring down subscriber churn to a record low in Q4.

- They have a much stronger content slate coming to Max in 2024 compared with 2023, including House of the Dragon season 2 in the next quarter, then The Penguin and Dune: The Prophecy later in the year. In 2025 we will see the release of new seasons of The White Lotus, The Last of Us, and Euphoria, followed in 2026 by the premier of the Harry Potter series.

- As well as listing the company's own films on Max, they've also signed a multiyear deal with A24 to bring all their theatrical releases exclusively to Max. A24 has produced some pretty big hits in the last few years, so this should be a good addition.

- They've signed deals with some pretty big names in the industry for their new films. This includes titles from Paul Thomas Anderson (director of There Will Be Blood) starring Leonardo DiCaprio, Sean Penn, and Regina Hall; Alejandro Inarritu (director of The Revenant) starring Tom Cruise; and Maggie Gyllenhaal (director of The Lost Daughter) starring Christian Bale, Jessie Buckley, Penelope Cruz, and Annette Bening.

- They're seeing an inflection in linear ad revenues so far in Q1, and an acceleration in ad revenue growth for streaming. This is particularly evident in certain European markets including Poland, Germany, and Italy, which all saw strong performance in linear advertising during Q4, that's continued into Q1.

- In Q4 they repaid $1.2bn of debt, bringing the total repaid for the full-year to $5.4bn. This leaves the gross debt balance at $44.2bn, which combined with the $4.3bn of cash on hand, equates to net leverage of 3.9x - in line with their target of achieving <4.0x leverage by the year-end.

- All the debt is fixed with an average duration of 15.0 years and an average cost of 4.6%. In the next three years they've got $1.8bn, $3.1bn, and $2.3bn of debt maturing, giving them plenty of flexibility around how much they repay.

- Once they get debt down to the 2.5x-3.0x range, share buybacks will be on the table as a capital allocation option.

- They don't believe the new sports streaming joint venture will accelerate the decline of linear sports viewing, as they're targeting it at the 60m sports fans in the US that don't currently have a cable subscription. I do get the impression though, that the Bleacher Report sports tier for Max might fall by the wayside as a result of this new product.

- Also related to sports, they're currently in discussions over renewing their exclusive NBA rights which they said have so far been "constructive and productive".

- They seem quite positive about the potential of the new sports streaming joint venture to help drive Max subscription growth through bundling. More generally they think bundling will be good for the company and the consumer, and remain fairly agnostic as to whether they're the ones to do it or companies like Amazon instead.

Overall quite a positive end to the 2023 and outlook for 2024. They've over-delivered on their targets for the year despite significant headwinds, and I remain confident in their strategy going forward. The biggest risk is that they move away from this with some misguided merger or acquisition.

Despite the chatter we've heard in the news around such potential deals, they were pretty dismissive of the idea in the earnings call. So I hope this stance was genuine.

I'll be digging into the 10-K in the coming weeks, so will update you on anything else I pull out of there.

tinyBuild

We've had some positive news from tinyBuild in the last week, which comes as a welcome change from the turmoil of recent months.

Kingmakers

On Tuesday (20 Feb), the company announced a brand new game called Kingmakers, that's been 5 years in development and is set for release in 2024.

It has garnered a lot of interest, with millions of views across YouTube and social media, as well as an appearance in IGN Fan Fest on Friday. This has helped drive the game to #83 in the Steam wishlist rankings, surpassing Streets of Rogue 2 as tinyBuild's most wishlisted game.

Level Zero: Extraction

We were told back in October last year that the release of Level Zero was getting pushed back to 2024 due to an increased scope for the game following its positive reception. On Wednesday we found out what this new scope looks like.

The game will retain its asymmetric horror core, but has now been morphed into an extraction shooter with a corresponding name change to Level Zero: Extraction.

A number of popular YouTubers focused on this genre were invited to a closed playtest, and sponsored to make videos that they posted after the new gameplay reveal trailer dropped.

The game has subsequently moved up to #213 in the Steam wishlist rankings, and the closed beta taking place between 15th-18th March (to which more influencers have been invited) will likely help drive it further.

So we now have 4 high potential releases scheduled for 2024: Streets of Rogue 2, Kingmakers, Level Zero: Extraction, and Broken Roads - with Sand and Ferocious more likely to come out in 2025. Let us hope this year serves as an inflection point for the company's fortunes (and those of shareholders).