Firm Returns Weekly - TBLD

Asterigos anniversary update

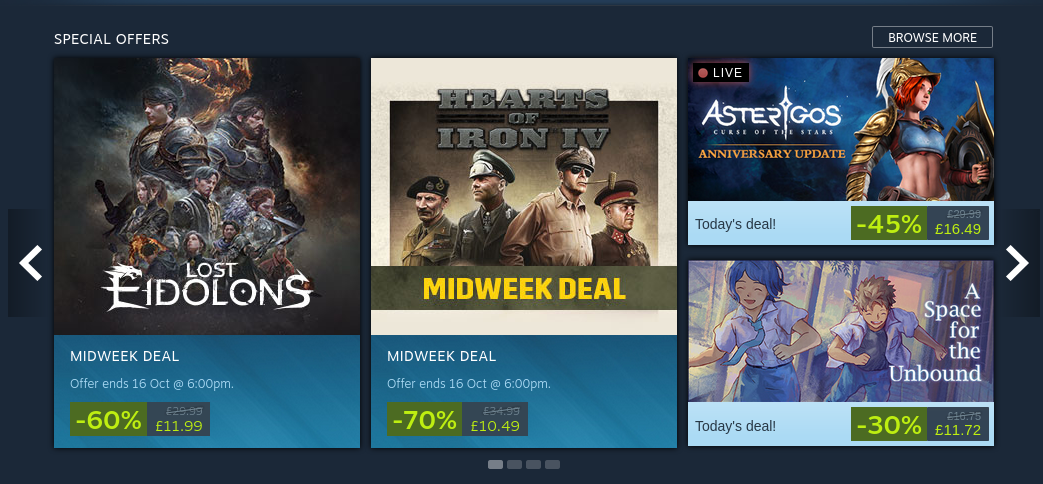

On Wednesday (11 Oct) Asterigos received a free anniversary update and featured as a daily deal on the Steam homepage.

There was also a developer Q&A livestream which got a good number of concurrent viewers - when I took the screenshot below there were 1,767.

The update, discount, and livestream helped to drive the game up into the top-100 selling games on Steam. As you can see below, I managed to capture a screenshot when it was in 63rd place.

The update has also significantly boosted engagement, with a very notable increase in the concurrent player count.

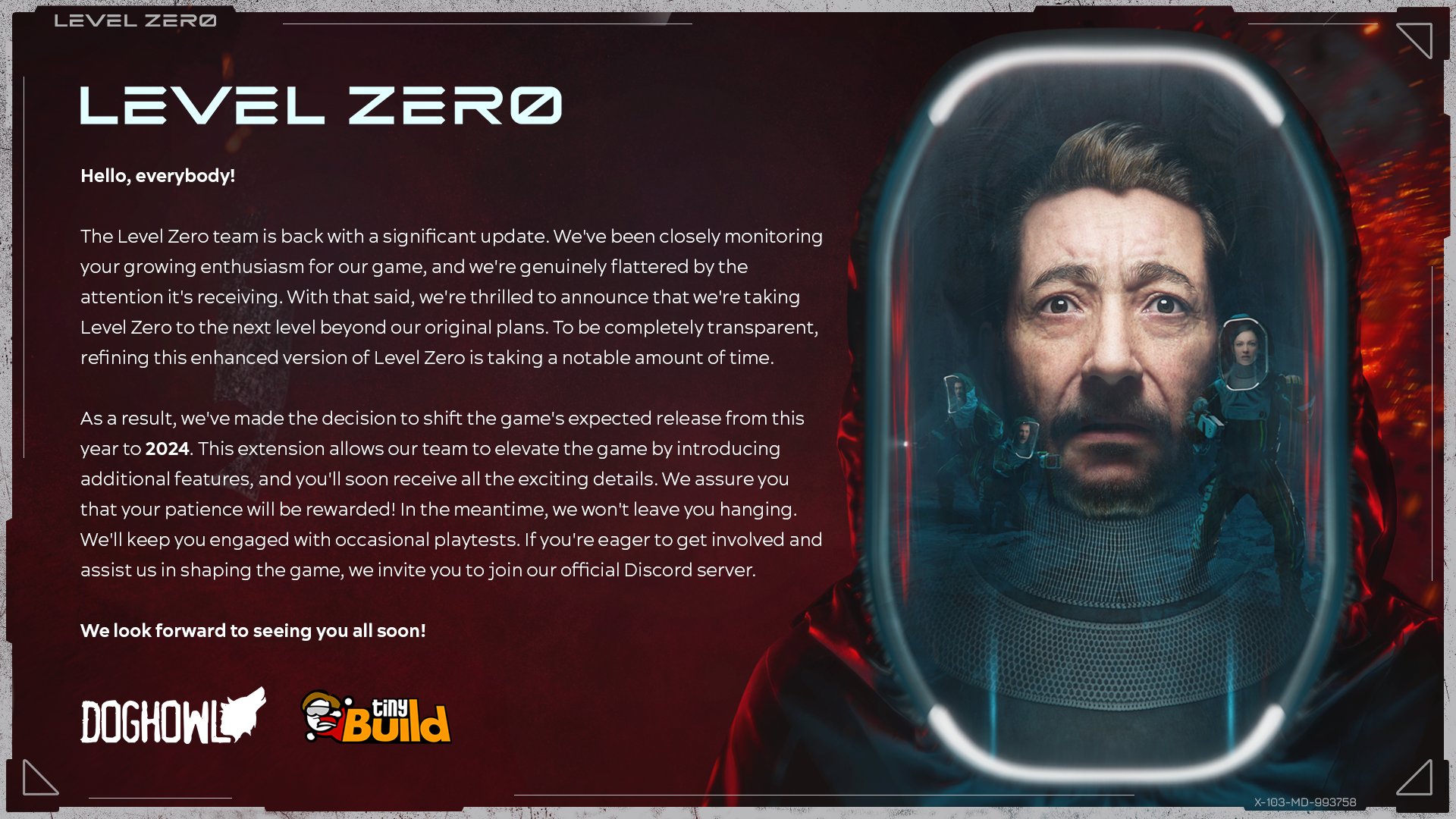

Level Zero pushed back to 2024

The release of Level Zero has been pushed back to 2024, largely due to the increased scope they're giving the game following its positive reception.

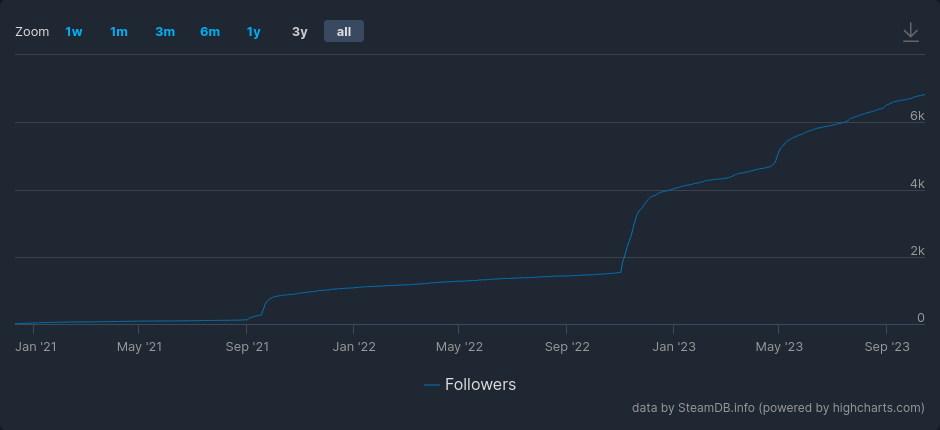

The game's following has grown very significantly over the last year, and it is currently in the top-300 most wishlisted games on Steam. We could be be looking at another top-200 title, with more than 100k wishlists when it comes to release - especially if the game has a well-received demo.

Q&A

I received a comment from a reader called Tim on a recent portfolio update that raised some concerns I hear quite frequently. Having spent quite a bit of time answering Tim's query, I thought I'd share my response. Thanks Tim for the question!

Question

I am a bit curious. You seem to be very convinced that this cash-bleeding company will turn around. If I read their material correctly, they have to either cut their development drastically (which surely doesn't help their revenue growth) or find a new source of cash within the next twelve months.

I also think that their capital allocation choices are rather questionable, given that they made heavily overpriced M&A deals during a time when everything was super-expensive and now they don't have any dry powder to buy anything in a world where bargains can be struck (or buyback their own shares if they so believe in a long-term future).

You wrote in the other article that they are "well-capitalized". But I think it is hard to agree to that given that they burned more cash in the last year than they have left at the moment.

From their reporting it is a bit difficult to understand whether they have spent those 16 mn $ on developers on their own payroll (which you can't just stop paying - if you want to have a future) or on software-service-providers (which you can stop paying) or a mixture of both.

You also write that "companies like these" trade with a 20 pe multiple. But I think what you forget in this calculation is that they normally do this whilst their revenue is growing fast. That can not be said about a company which lost 20 - 35 % of their revenue within a year.

What exactly do you base your confidence on? Happy to hear your arguments!

Answer

Hi Tim, thanks for the comment.

Before I address your concerns individually, I want to preface my answers with a couple of points which might add some helpful context and perspective.

Firstly, they were profitable prior to their IPO and have been self-financing their operations for many years - capital injections from external investors, including the 2021 IPO, have been used to accelerate growth.

Secondly, at the current price the short-term investment case is simply that they don't go bankrupt. Even if they stabilised cash flows and reduced capex to a maintenance level (so there was no growth) you'd see something like a 5x, as net profit recovered and they returned to a very modest earnings multiple. If the market didn't respond accordingly, they could soon boost the stock price with share buybacks - which they have expressed a willingness to do once cash becomes available.

You might like to read this weekly update where I covered the interim results and management's forward guidance: https://www.firmreturns.com/firm-returns-weekly-2023-09-30/

Now to address your points. There are a number of factors that have skewed the current cash flow picture. The first is the cash raised from the IPO ($46.8m) which was subsequently invested in a very substantially expanded development pipeline containing a mix of internal and external projects. There was also a decent amount of M&A activity, which I'll touch on later. The key thing to note with the investment made in software development, is that it can take 2-5 years for the games to be released and start producing revenue. As a result of this lag, the ramp up in software development expenses turned FCF negative.

The second factor is the unexpected drop in development services revenue (payments from distribution platforms to list tinyBuild's games in subscription libraries e.g. Xbox Game Pass, PS Plus, etc), which had grown to be around 30% of revenue over the last few years. The company had evidently factored revenue from development services into their cash flow projections, and the subsequent drop has meant they're having to wind back some of their software development expenditure to rebalance cash flows.

With regards to the next 12 months, management has stated their clear intention to keep cash between $10m-$20m this year and maintain this level in 2024 - implying the company will be FCF break-even (I calculate what OCF will need to be in H2 2023 to make this happen in the update linked above). They also stated very clearly in their recent earnings call that they can ramp up or down development expenditure whenever they like (while they have several internal studios e.g. Hologryph, a lot of development is done by external studios); though they don't want to go overboard in cutting back as this would impact revenue growth as you suggest. Total capex for 2023 is expected to be around the same as 2022 (c.$35m) and might come down a little next year to match expected OCF (maybe $30m?), so drastic cuts should not be necessary.

To address your "well capitalised" point, they currently have a net cash position which they intend to maintain. During the earnings call, Jaz (the CFO) directly addressed concerns around whether they'd use debt to fund software development expenditure. They intend to entirely self-finance capex from their operating cash flows, and will cut back if revenues fall below their expectations. The $35m credit facility they have in place was only ever intended to finance an "unmissable" M&A opportunity, but thus far such an opportunity has not arisen (prices for private market acquisitions haven't come down to match public markets yet), and their efforts are focused on their internal pipeline at the moment (which consists of 50+ projects).

On your capital allocation point, it's worth bearing in mind that a large component of the consideration paid for those acquisitions consisted of tinyBuild's shares which were trading at a very elevated level at the time (north of £2 per share for many of them), meaning they arguably got quite a good deal! The transactions were also structured with a large contingent consideration component, where payment is dependent on certain performance thresholds being met. In several cases, underperformance has resulted in contingent payments not being made - most notably Versus Evil/Red Cerberus where c.$11m of contingent consideration was written off.

In terms of the quality of acquisitions, they have in aggregate been pretty good. Some of their highest potential IP was acquired e.g. Streets of Rogue and Deadside. The price paid for Streets of Rogue is looking particularly attractive given the wishlist ranking of Streets of Rogue 2, and high potential for expansion of the IP into a multi-media franchise (see how the animated trailer was received, for example). In general, tinyBuild has had a pretty good acquisition record when acquihiring IP/development studios with which they've worked before (Deadside is a bit of an exception, though I believe they knew the developers despite not having worked with them).

The biggest error they've made with M&A was Versus Evil/Red Cerberus, where they had no working relationship, and underestimated how difficult it would be to alter the culture and shift the publisher towards an own-IP model. Management has been very open and transparent about their mistake here, and as mentioned above, the structure of the transaction helped protect tinyBuild from the studio's subsequent underperformance. However, Versus Evil does have a number of high potential titles releasing in the next couple of months - most notably Broken Roads - which means we could see some positive contribution in H2.

On the 20 P/E comment, their revenue has historically grown very rapidly. The drop in development services revenue is a short-term headwind, but with the size of their pipeline I expect growth to resume again relatively soon. At which point we'll likely see multiple expansion and a change in sentiment to match. The current dip has in my view created a phenomenal buying opportunity with very large asymmetry - as long as the company doesn't go bankrupt, it's pretty well all upside.

Finally, to address the question of confidence, mine has three key aspects.

Firstly, that they will balance cash flows and not allow the business to fail. This is backed up by Alex, the CEO's, very substantial insider ownership (37.8%), which I believe constitutes a large portion of his overall wealth. Beyond this, there is also the welfare of the employees, which the company has demonstrated it values highly.

Secondly, their strong publishing capabilities - demonstrated by numerous successful releases - which will allow them to maximise the return on their high potential IP.

Thirdly, their reputation and strong relationships with developers - built through initiatives such as the DevGAMM conferences - that allows them to source new high potential IP.

I hope this comment and the linked article answer your questions.

James