Company Updates - AV

Aviva has acquired Probitas for £242m, granting it access to the Lloyd's market for the first time in over 20 years; and posted a strong set of results for 2023.

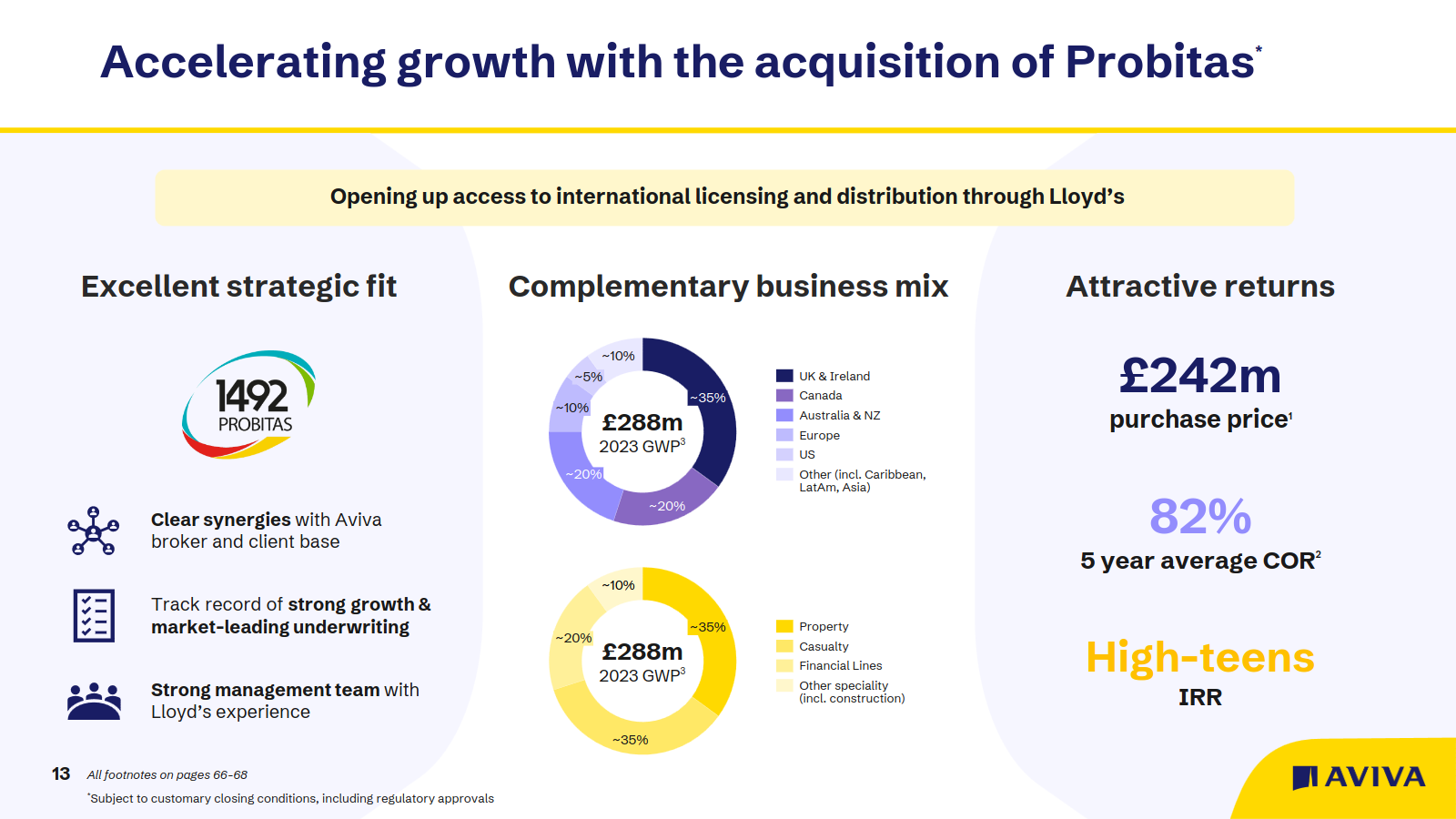

Acquisition of Probitas

On Monday (4th March), Aviva announced the acquisition of Probitas for total consideration of £242m. As part of this transaction, Aviva will be acquiring Probitas' fully-integrated Lloyd's platform, encompassing its Corporate Member, Managing Agent, international distribution entities, and tenancy rights to Syndicate 1492.

If you're unfamiliar with the Lloyd's market, here's a brief overview: it consists of 77 Syndicates, each managed by a Managing Agent, and containing one or more Members that underwrite insurance. Firms that buy insurance through Lloyd's benefit from three levels of security against their claims: 1st, the Syndicate level assets consisting of the premiums received; 2nd, the Members Funds held at Lloyd's; and 3rd, the central fund of mutual assets pooled by the Syndicates.

There are many companies that won't do business with an insurer unless they are a member of Lloyd's, due to the surety of payment provided by the chain of security outlined above. Aviva's reentry into this market - having left in 2000 after selling Marlborough Underwriting Agency to Berkshire Hathaway - immediately opens up a large pool of new customers for the Group's Global Corporates (GCS) business.

Aviva's management have apparently been in discussions with Probitas for the last couple of years, while weighing up their various options for entering the Lloyd's market. The acquisition of Probitas was chosen because of both the Syndicate's strong performance over the last 5 years (21% CAGR in gross written premiums, and average COR of 82%), and the complementary business mix, with the majority of premiums written for policies in the UK, Ireland, and Canada - Aviva's core markets.

The price paid for the business is c.7x management's estimate of 2026 post-tax IFRS operating profit, and they expect a high-teens internal rate of return. It is their intention to provide additional capital to the Corporate Member in order to continue the Syndicate's growth in gross written premiums.

https://www.londonstockexchange.com/news-article/AV./acquisition-of-probitas/16358947

2023 results

On Thursday (7th March), Aviva released their full-year results for 2023 and held a conference for analysts shortly thereafter. It's fair to say the Company had a strong year, with solid growth across the Group, upgraded 3-year targets, and further capital distributions to shareholders. Here are some of the highlights:

- At the Group level, IFRS operating profit was up 9% to £1,467m (2022: £1,350m).

- Solvency II (SII) operating own funds generation (OFG) grew 12% to £1,729m (2022: £1,540m) and SII operating capital generation (OCG) grew 8% to £1,455m (2022: £1,352m).

- SII return on equity (operating own funds generation divided by opening own funds) increased to 14.7% (2022: 9.9%).

- Cash remittances increased by 3% to £1,892m (2022: £1,845m). This figure along with SII OFG and OCG determine how much headroom management has for dividends, share buybacks, and further bolt-on acquisitions.

- IFRS profit for the year was £1,106m (2022: £1,030m loss). I generally don't put too much weight on this figure, as it is highly susceptible to short-term movements in asset valuations that won't be realised for many years, and don't impact regulatory capital.

- Adjusted IFRS shareholders' equity (including IFRS 17 contractual service margin) at 31 Dec 2023 was £14,055m (2022: £14,103m) or 513 pence per share (2022: 502 pence).

- At 31 Dec 2023, SII shareholder cover ratio stood at 207% (2022: 212%) - comfortably above their target level of 180%, leaving room for further acquisitions or returns of capital. The Probitas acquisition would have shaved about 3% off this figure had it occurred before the year-end.

- The Group now has more than 19m customers, with 4.8m purchasing two or more Aviva products. They've also added a further 600k users to their MyAviva app, bringing the total to 6.3m.

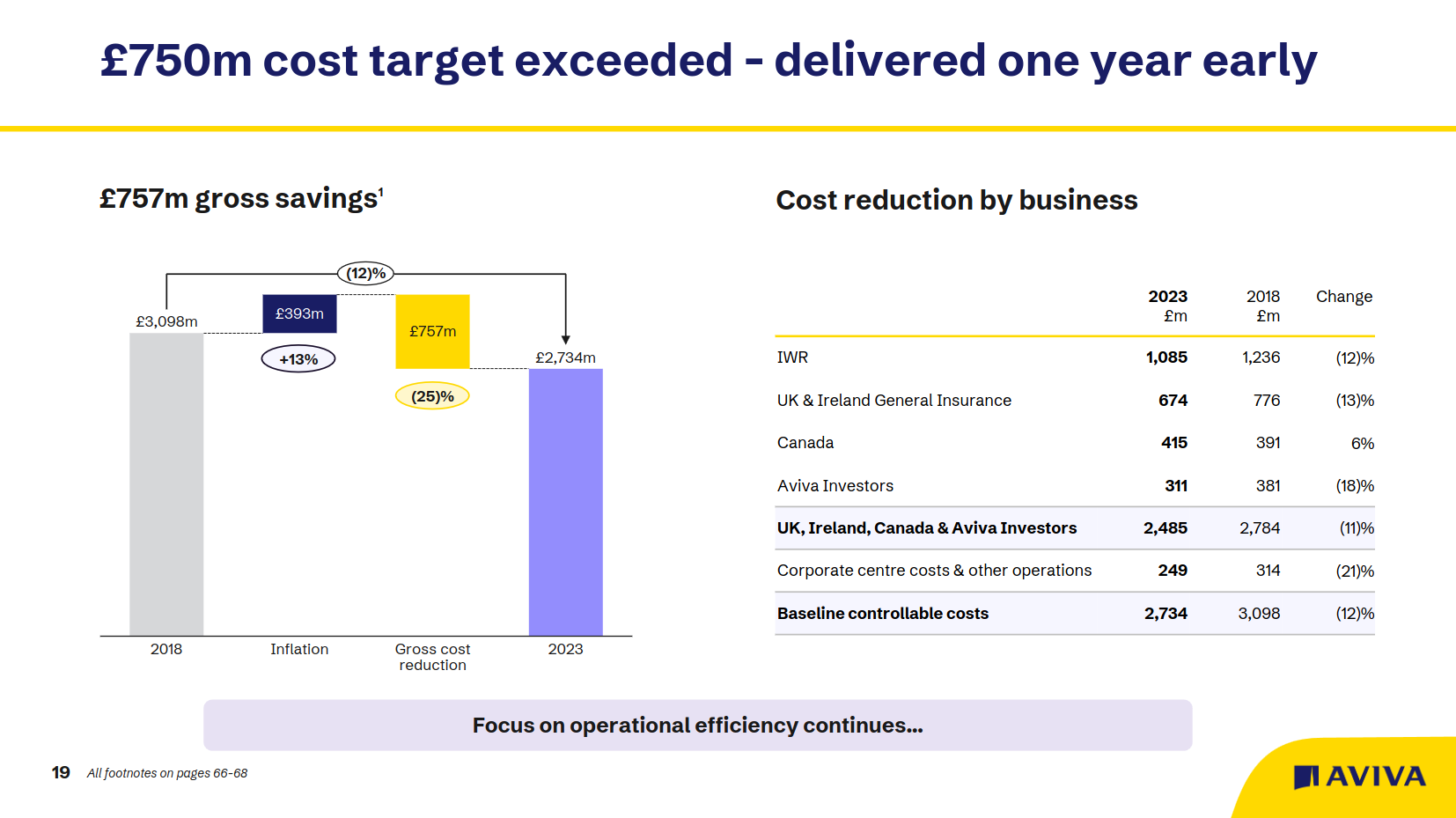

- They've delivered their target of £750m in gross cost reductions ahead of schedule:

- They've declared a final dividend of 22.3 pence per share (2022: 20.7 pence), bringing the total dividend to 33.4 pence (2022: 31.0 pence) equating to a cash cost of c.£915m. Their dividend guidance has also been raised to mid-single digit growth in the cash cost of the dividend from low-to-mid single digit, reflecting their more confident outlook.

- In addition to the dividend, they have announced a new £300m share buyback programme, matching the £300m from the previous year. This will commence immediately and bring the total returns to shareholders for the year to £1,215m (around a 10% yield on the current market cap). Management intends to make regular and sustainable returns of capital, so we can expect to see similar returns going forwards.

- Having met several of their targets a year early, they have now provided a new set of upgraded Group targets:

- £2bn in IFRS operating profit by 2026.

- £1.8bn in Solvency II operating own funds generation by 2026 (prior target was £1.5bn by 2024).

- >£5.8bn in cumulative cash remittances from 2024-2026 (prior target was >£5.4bn from 2022-2024).

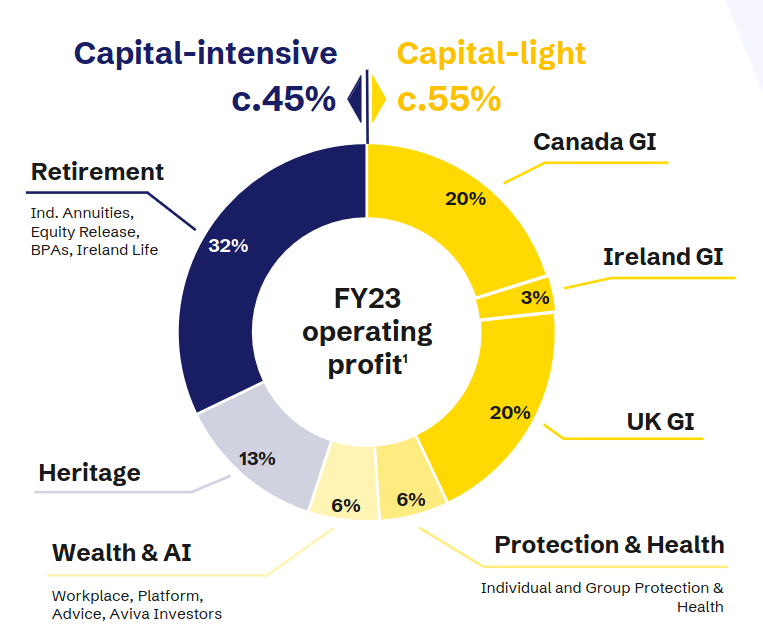

- The business has now transitioned to being majority capital light:

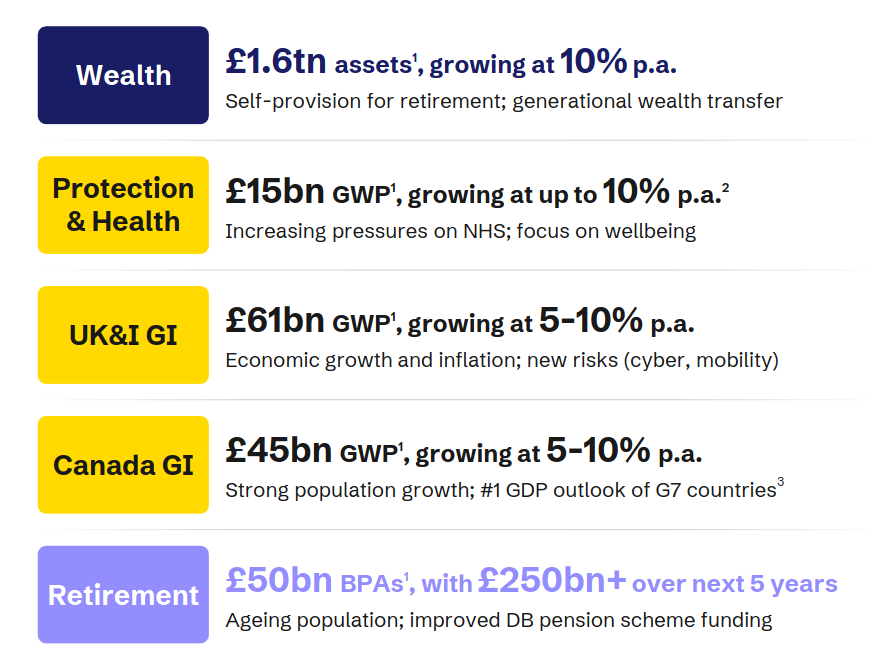

- Management expects to see underlying organic growth across many of the markets in which they operate, even before considering the potential for market share gains:

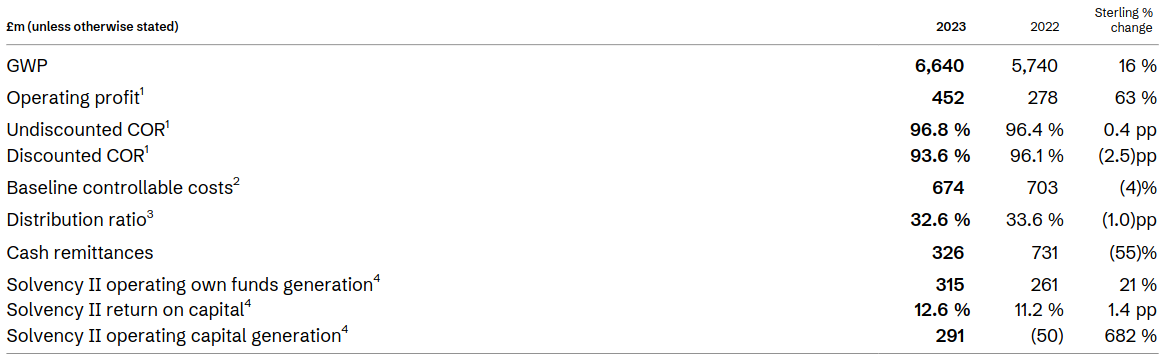

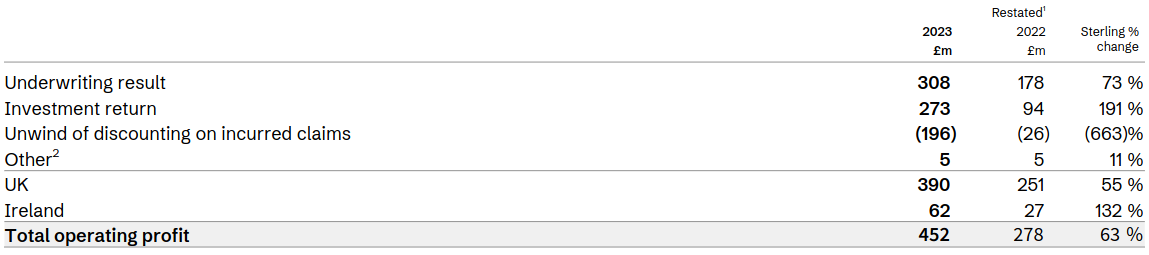

- Moving on to the segmental results, let's start with UK & Ireland general insurance:

- As you can see, gross written premiums increased 16% to £6,640m (2022: £5,740m). Of this total, £2,956m (2022: £2,386m) was attributable to UK personal lines, £3,231m (2022: £2,931m) to UK commercial lines, and £453m (2022: £423m) to Ireland.

- Cash remittances were lower at £326m (2022: £731m), primarily due to more being paid out from the general insurance business in the prior year, in order to preserve cash in IWR during the bond crisis that followed the UK Autumn budget.

- Overall combined operating ratio (COR) worsened slightly to 96.8% (2022: 96.4%) on an undiscounted basis. This resulted from a higher COR for UK commercial lines (97.9% vs 96.6%) more than offsetting decreases in UK personal lines (95.9% vs 96.2%) and Ireland (96.0% vs 96.1%).

- The discounted COR applies a discount rate to the incurred claims to represent the returns that can be made on cash before it's paid out. With interest rates being higher in 2023 vs 2022, the discounting had a more significant impact on the COR. It should be noted that this discounting gets unwound during the calculation of operating profit, as follows:

- Operating profit and SII OFG grew by 63% and 21% to £452m (2022: £278m) and £315m (2022: £261m), respectively.

- For the UK & Ireland general insurance segment as a whole, Aviva is the #1 player with a 12% share of gross written premiums.

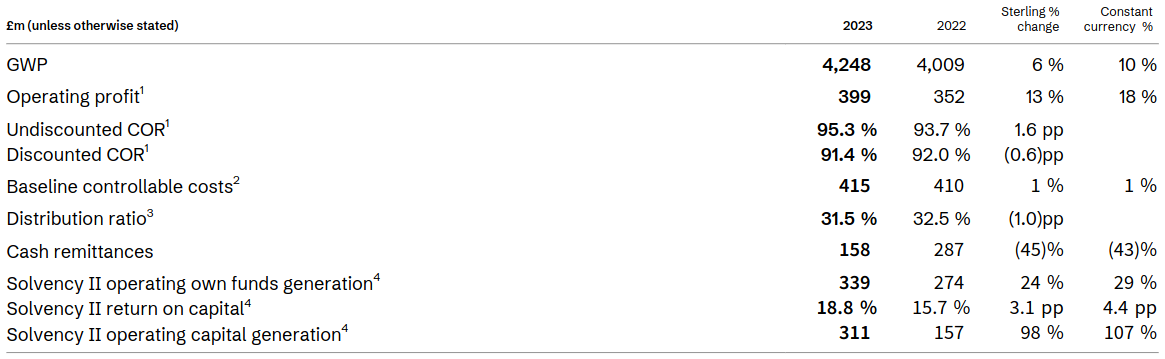

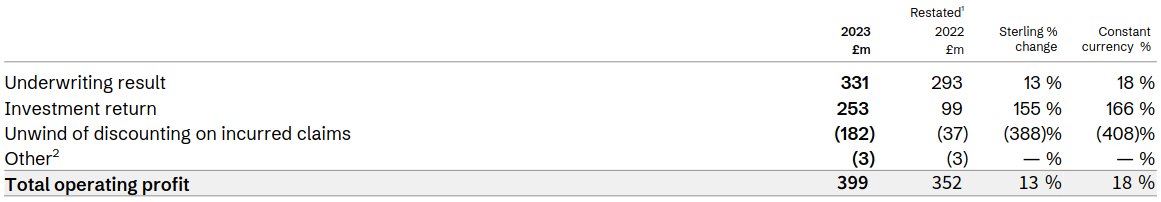

- Canada general insurance:

- Gross written premiums grew 6% to £4,248m (2022: £4,009m), with the constant currency increase being higher at 10%. Of this total, £2,574m (2022: £2,466m) was attributable to personal lines, and £1,674m (2022: £1,543m) to commercial lines.

- Cash remittances were lower at £158m (2022: £287m) for the same reason as UK&I general insurance.

- The undiscounted COR increased to 95.3% (2022: 93.7%) due to a deterioration in personal lines (99.5% vs 95.2%) more than offsetting an improvement in commercial lines (88.0% vs 90.9%).

- Operating profit and SII OFG grew by 13% and 24% to £399m (2022: £352m) and £339m (2022: £274m), respectively. These increases were 18% and 29% on a constant currency basis.

- Aviva is currently the #2 player in Canada general insurance, with a 9% market share by gross written premiums.

- Insurance, Wealth and Retirement (IWR):

- Cash remittances increased 76% to £1,369m (2022: £780m) due to the unwind of the aforementioned cash retention measures enacted in 2022.

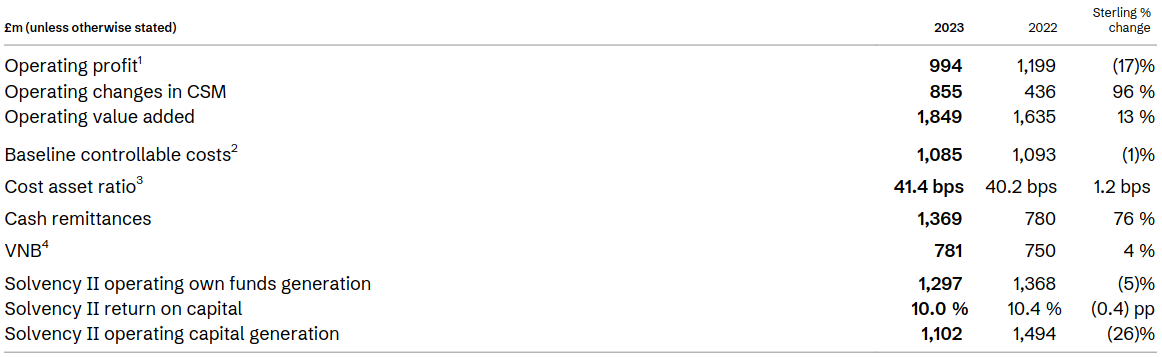

- 2023 saw the adoption of the new IFRS 17 rules, which has resulted in the stock of profits related to future periods being held in a contractual service margin (CSM), and then released to operating profit over time. The combination of operating profit and operating changes in the CSM gives you the operating value added in the year. We can see that this rose by 13% to £1,849m (2022: £1,635m), as the 96% increase in contributions to the CSM outweighed the 17% decrease in operating profit.

- Operating value added is significantly larger than operating profit for the retirement (annuities and equity release) business, and protection and health (insurance) business, as profits from sales made today are recognised over multiple years. Conversely, the wealth business doesn't see any major difference between operating profit and operating value added, while the heritage business actually has higher operating profit than value added due to fact it's in run-off, and not making any new sales.

- The wealth business is an important avenue for growth, and it saw AuM grow 15% to £169,991m (2022: £147,429m), with net flows of £8,307m (2022: £9,135m). Revenue grew 11% to £620m (2022: £560m), while operating profit decreased 19% to £100m (2022: £124m) due to investments made in the business to drive future growth.

- Annual Premium Equivalents (APE) for health increased 41% to £151m (2022: £107m), while individual protection APE increased 13% to £152m (2022: £135m), and group protection APE decreased by 4% to £112m (2022: £117m). Aviva is now #3 in health with a 14% market share, and #1 in protection with an 18% market share.

- Present value of new business premiums (PVNBP - a measure of sales, incorporating the present value of new regular premiums) for individual annuities rose 17% to £1,164m (2022: £995m), and bulk purchase annuity PVNBP rose 24% to £5,501m (2022: £4,436m). This was partially offset by a 48% reduction in equity release PVNBP to £423m. These results can largely be explained by higher interest rates, which make annuities more appealing but equity release less so.

- Aviva is now #1 in individual annuities with a 21% market share, #1 in equity release with a 17% market share, and #4 in bulk purchase annuities with an 11% market share.