Company Updates - ECOR

Highlights from Ecora Resources' 2023 full-year results announcement, including their new capital allocation framework and $10m share buyback programme.

On Wednesday (27 Mar), Ecora Resources released their full-year results for 2023 along with the announcement of a new capital allocation framework and the commencement of a $10m share buyback programme.

Here are some highlights from the results announcement and presentation:

- As stated in the company's Q4 trading update, total portfolio contribution for 2023 was $63.6m (2022: $143.2m). The drop versus the prior year was largely a result of record high met coal prices ($325/t vs $225/t) and substantially higher volumes (4.1Mt vs 1.6Mt) at Kestrel in 2022.

- Saleable production volumes within Ecora's private royalty area at Kestrel are expected to be 15-25% higher in 2024 than 2023, weighted towards H1. 2025 is likely to be much the same as 2024, and royalty payments are expected to cease entirely in 2026.

- The pace of the underground mine expansion at Voisey's Bay has been slower than anticipated, resulting in just 11 cobalt deliveries (of 20t each) being made in 2023 compared with 19 in 2022. This, combined with a much lower average cobalt price of $16/lb (2022: $32/lb), led to a net portfolio contribution (after subtracting cost of sales) of $4.2m (2022: $14.6m). It's worth noting that the sale price of cobalt from Voisey's Bay exceeds the price quoted on the London Metal Exchange by around 30% due to it being higher quality, alloy-grade cobalt.

- Ramp-up of the underground mining operations is now expected to start in H2 2024, resulting in 12 to 16 deliveries of cobalt in 2024. Once fully operational, steady-state production should equate to approximately 40 deliveries per annum. We can therefore expect a significant increase in portfolio contribution over the coming years.

- Somewhat higher volumes are also expected from Mantos Blancos as the mine operator, Capstone Copper, is investing in new equipment to de-bottleneck the processing plant. Their production guidance for 2024 is between 49Kt and 57Kt of copper, depending on how long the equipment installation takes. For comparison, the mine produced 49.3Kt of copper in 2023 and 48.8Kt in 2022, with royalty payments of $6.1m and $6.0m, respectively.

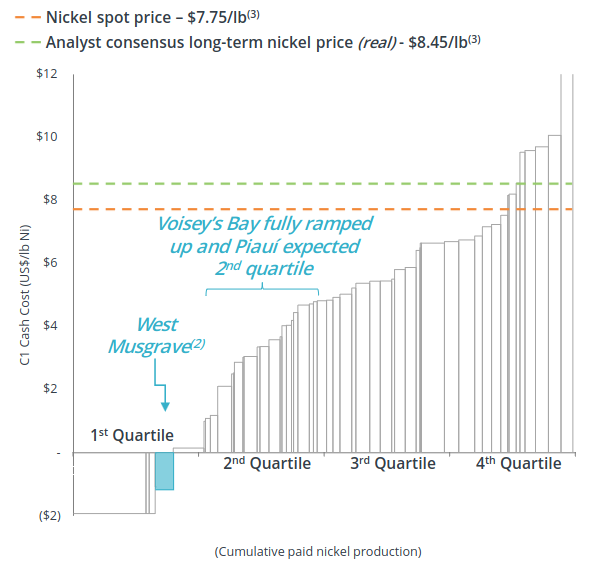

- Due to Indonesian operators flooding the nickel market and driving the price down below $17,500 per tonne, there is now a chance that BHP will pause construction of West Musgrave, as several other Australian mine operators have done. However, West Musgrave is expected to have a very low nickel production cost ($1.10/lb), and will be generating a significant amount of copper (c.40% of revenue at current prices). It should therefore continue to be economical.

- They deployed a significant amount of cash during 2023, including: $36.7m of deferred consideration for the West Musgrave/Santo Domingo royalty acquired in 2022; $20.0m for the 0.25% NSR royalty over the Vizcachitas project; and a further $7.5m investment into the Piaui nickel-cobalt project, bringing Ecora's total GRR royalty to 1.6%.

- It sounds quite likely that they will use their option to acquire a further 2.65% royalty over Piaui for $62.5m if and when the project reaches the construction phase. With the projected output of the mine (27ktpa of nickel and 1ktpa of cobalt), a 4.25% GRR royalty would yield c.$19m per annum at current prices; so it remains an attractive investment for Ecora. The question will be whether the mine remains sufficiently economical for the operator to justify construction.

- They generated $29.7m in free cash flow during the year (2022: $132.1m). Additionally, $13.7m was realised from the partial disposal of Ecora's stake in LIORC, along with $5.3m in deferred and contingent consideration from Whitehaven Coal in relation to the 2021 disposal of the Narrabri royalty.

- Net debt stood at $74.6m at 31 Dec 2023 (2022: $36.4m), and absent further acquisitions, is expected to peak at less than $90m during H1 2024. The leverage ratio at the year end was 1.4x and should remain comfortably below 2.0x at the expected peak.

- Earlier this year, the Company secured an extension to their $150m revolving credit facility, pushing the maturity date out to Jan 2027 and adding an additional accordion feature for an extra $75m to fund royalty acquisitions. The maximum leverage permitted by this facility is 3.5x, with the potential to increase this to 4.5x for a period of 6 months following certain acquisitions (presumably ones that will begin producing in the next 6 months). The interest payable is SOFR plus 2.25% to 4.00%, depending on leverage levels.

- Management has announced a new capital allocation framework with four key components:

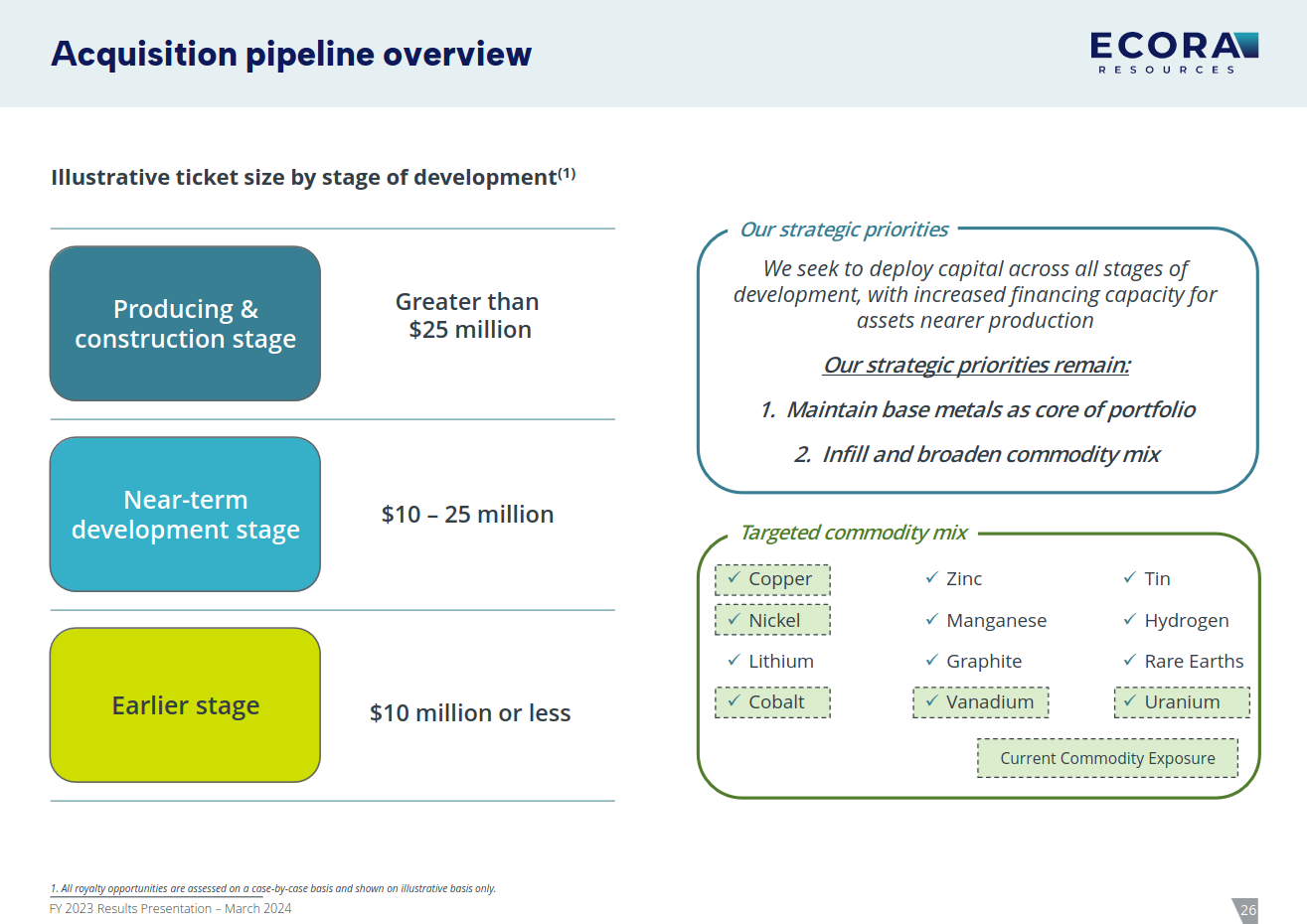

- Further acquisitions to diversify and grow the portfolio.

- Post-transaction balance sheet deleveraging.

- Semi-annual cash dividends based on a range of 25%-35% of free cash flow - previously dividends were paid on quarterly basis at a fixed rate of 2.125c per share.

- Share buybacks when the shares trade at a large discount to NAV (currently c.50%).

- As acquisitions are going to be largely funded by debt in the near-term, any development stage acquisitions that are not currently or imminently cash flowing will be restricted to a maximum of $25m. Producing or construction stage acquisitions could be larger (e.g. Piaui).

- In line with their new capital allocation framework, the Company has commenced a $10m share buyback programme. This should be highly accretive given the wide discount to NAV presented by the current share price, and equates to c.4% of the company's market cap.