Company Updates - ECOR

Q1 2024 trading update and outlook for the rest of 2024.

Last Wednesday (24 Apr), Ecora Resources released a trading update for Q1 2024. This follows the release of their full-year 2023 results on 27 Mar, and given the proximity, there aren't any surprises. Let's go through some of the highlights:

- Overall portfolio contribution was up 117% to $19.5m vs Q4 2023 ($9.0m, excluding $5.4m of accrued income released following the favourable Four Mile judgement).

- Most of this came from Kestrel, which saw a 314% increase to $14.5m (4Q23: $3.5m) as mining moved back into Ecora's private royalty area. It is expected to remain within Ecora's royalty area during Q2, before leaving during the second half of the year. Full year volume guidance remains unchanged at a 15-25% increase on FY23, equating to 1.84-2.0Mt (FY23: 1.6Mt).

- Two 20t cobalt deliveries were received from Voisey's Bay, down from four in Q4 2023, with a consequent halving in net portfolio contribution (after subtracting cost of sales) to $0.8m as the average realised sales price remained unchanged at $16.0/lb. With underground mining activity expected to ramp up in H2, production guidance remains unchanged at 12-16 deliveries for the full year (FY23: 11 deliveries).

- Contribution from the rest of the portfolio was slightly up on the prior quarter at $4.2m vs $4.0m, with increases from Four Mile (excluding release of accrued income), McClean Lake, and EVBC outweighing decreases from Mantos Blancos, LIORC (following the partial sale) and others.

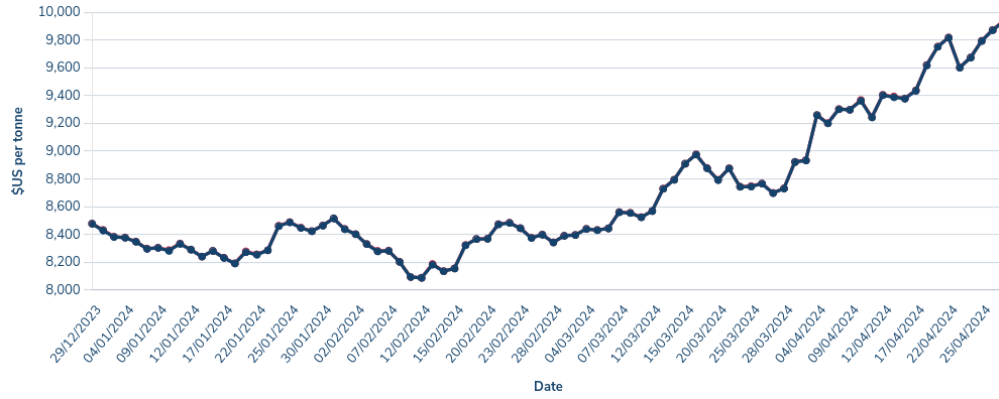

- The price of copper has strengthened significantly since the end of Q1, so I'd expect a solid Q2 from Mantos Blancos and the other copper royalties (production volume dependant).

- Management continues to expect year-on-year production volume growth across the portfolio in 2024 and 2025.

- At 31st March, net debt stood at $87m (YE23: $75m), around the peak expected for the year (assuming no further acquisitions).

- There are a couple of project milestones/de-risking events expected during the remainder of the year:

- Capstone Copper is scheduled to release an updated Feasibility Study for Santo Domingo in Q2; and

- BHP stated on 18th April that they will be announcing the results of a review into the potential phasing and capital spend for West Musgrave in August.

https://www.londonstockexchange.com/news-article/ECOR/q1-2024-trading-update/16437305