Firm Returns Weekly - tinyBuild (TBLD), Warner Bros Discovery (WBD), Aviva (AV), and Fuller, Smith & Turner (FSTA)

tinyBuild

Broken Roads release delay

Broken roads was scheduled to release on 14 November, but on the 8th they announced it would be delayed until early next year.

There was still some confusion because they forgot to change the release date on Steam, which resulted in the game appearing in the popular upcoming games list on the 14th - perhaps this was by design?

The delay seems to have been relatively well received, with an additional 500 followers added since the 14th, and the game now sitting at #118 in the Steam wishlist rankings.

It remains to be seen whether this will impact tinyBuild's ability to hit its cash targets for year-end 2023, but a delayed launch is ultimately better than releasing a buggy game that flops.

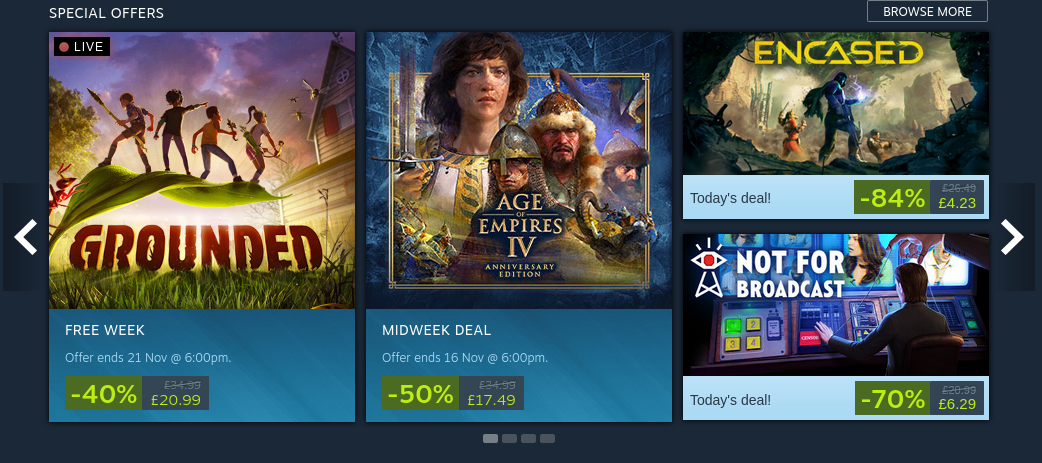

Not For Broadcast: Bits of Your Life DLC

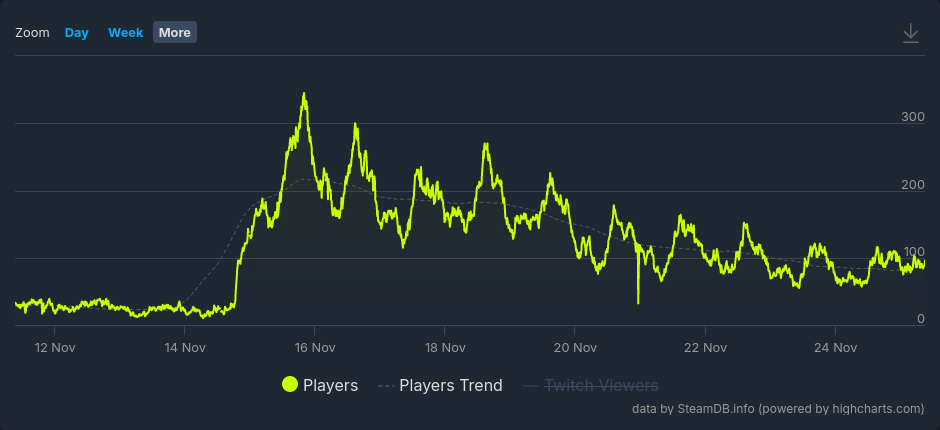

Something that did release on 14 November was the Bits of Your Life DLC for Not For Broadcast. The base game was featured in a daily deal on the Steam homepage, with a 70% discount to help drive traffic to its store page, where the new DLC was advertised.

The base game saw a very significant boost in sales - reaching #102 in the top-sellers list at one point - which combined with returning players who came back for the new DLC, generated a healthy increase in concurrent players.

Warner Bros. Discovery

Hogwarts Legacy released on Switch

Another thing that released on 14 November was the Switch version of Hogwarts Legacy. Porting this game to the Switch was always going to be an ambitious task, but it seems they've managed to do it without diminishing the experience for players too much. Most of the reviews I've seen have been positive.

Max Black Friday discount

WBD is offering a 6 month subscription to Max's ad-supported tier at a 70% discount for Black Friday. We'll have to see what this does to overall subscriber numbers in Q4.

Dune: Part Two release brought forward

The release date for Dune: Part Two has been brought forward by 2 weeks to 1 March 2024, filling a slot vacated by The Fall Guy which has been pushed back to 3 May. It was of course previously intended for release in 2023, but got impacted by the strikes.

Dr Martens collaboration

Finally for WBD, I wanted to mention a collaboration they've done with Dr Martens - the footwear brand - to celebrate the 100-year anniversary of Warner Bros. Studios.

https://www.drmartens.com/uk/en_gb/collaborations/warner-bros-studio

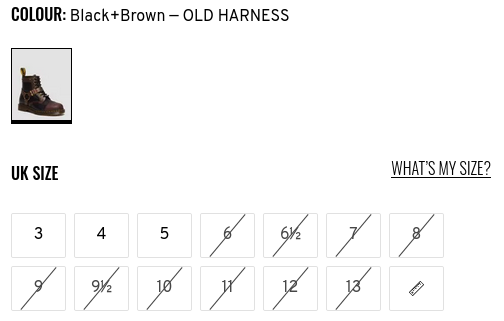

The collaboration includes several special edition Blade Runner and Mad Max: Fury Road boots, along with a reporter bag. One of the two Fury Road boot styles is shown below.

Judging by their current stock availability, they're selling well.

It's a good time for them to be putting Mad Max: Fury Road into peoples minds again, since they're going to be releasing a prequel film called Furiosa next year.

Aviva Q3 trading update

On 16 November, Aviva released a Q3 trading update. Here are the highlights:

- At a Group level things are looking robust: Solvency II shareholder cover ratio is 200%; Solvency II debt leverage ratio is 30.6%; and centre liquidity is £1.5bn.

- They're maintaining their guidance for 5-7% growth in operating profit from £1,350m in 2022, and expect to pay a total dividend of c.£915m or c.33.4p per share for 2023. They also expect to beat their targets of £1.5bn own funds generation in 2024 and cumulative cash remittances of £5.4bn from 2022-24, along with £750m gross cost reduction (though inflation has eaten a fair amount of these savings already).

- Moving to the segments. General Insurance has held up fairly well despite the inflationary environment, with gross written premiums for the first 9 months of 2023 up 11% at £8,044m vs £7,225m 9M22.

- However, the undiscounted COR for the 9M rose 2.1pp to 96.3% from 94.2%, with a 3% rise in Canada due to the recent wildfires. In Q3 the impact was particularly pronounced, with Canada's undiscounted COR rising to 104.1%.

- Since the period end, the UK has been hit by Storms Babet and Ciaran, but thus far the impact has been within Aviva's long-term average weather assumption of c.4pp of undiscounted COR.

- In Insurance, Wealth & Retirement (IWR), protection & health sales for 9M23 were up 23% to £330m vs £268m 9M22, driven by 56% growth in health sales (as people turn to private healthcare due to the decline of the UK National Health Service).

- In wealth, workplace net flows saw a substantial 26% increase to £5,114m from £4,055m 9M22, as the business won 357 new schemes and benefited from the positive impact of wage inflation on employee contributions.

- This increase was unfortunately more than offset by declines in platform and individual pension net flows, which decreased the overall net flows to £6,474m from £7,024m the prior year - people aren't investing as much outside of their workplace pensions.

- In retirement, sales were pretty well flat at £4,356m (9M22: £4,276m) as higher BPA and individual annuity volumes were offset by substantially lower equity release volumes - higher rates make annuities more attractive but reduce the appeal of equity release.

- Aviva Investors saw a 1% decrease in assets under management to £218bn, but still managed to attract £498m of external net inflows.

Fuller, Smith & Turner half-year results

On the 15 November, Fuller's released their half-year results for the 26 weeks to 30 September. Here are a few key takeaways:

- Revenue for HY24 rose 12% to £188.8m vs £168.9m in HY23, split between £172.5m (HY23: £153.8m) from the managed estate and £16.3m (HY23: £15.1m) from the tenanted estate. The EBITDA contributions from the two segments were £37.1m (HY23: £30.0m) and £8.3m (HY23: £7.8m) respectively, illustrating the much higher margins on the tenanted estate.

- Overall EBITDA was £34.8m (HY23: £28.9m) after subtracting £10.6m of central and other costs from the segmental contributions.

- Operating profit increased 37% to £21.4m vs £15.6m in HY23, while profit before tax increased 39% to £14.9m vs £10.7m in HY23. Profit after tax growth was slightly lower at 32% due to higher corporation tax rates (25% vs 19%) - the net profit figure was £10.7m (HY23: £8.1m).

- Cash generated from operations saw a decided increase of 26% to £31.7m from £25.2m HY23, while capital expenditure on property, plant and equipment fell substantially to £9.0m from £14.9m. They used these cash flows to, amongst other things, repay £7.0m of debt, pay a £6.1m final dividend, and repurchase £3.5m of shares.

- Net debt (excluding leases) stood at £129.4m at period end, with a leverage ratio of 2.6x, and undrawn credit facilities of £86.5m. Interest is well covered at c.5x, but it would be good to see leverage come down now interest rates are significantly higher.

- In July 2024, they will be completing the sale of a property in Southwark which will realise £20m of value. It will be interesting to see the profit they make on this sale, as a representative example of how undervalued their estate currently is.

- Inline with the increase in profit, they've announced a 42% increase in the interim dividend to 6.63p per share vs 4.68p in HY23, taking it back up to 85% of its 2019 level. They have also commenced a further share buyback program for an additional 1m shares.

https://www.londonstockexchange.com/news-article/FSTA/half-year-results/16209935