Somero Enterprises, Inc. Research Report

The size of this highly profitable and growing US industrial company makes it too small for many institutional investors, which in turn creates an attractive opportunity for individuals. Adequate margin of safety is provided by a robust balance sheet, with net cash, and a P/E of 7.1. The prospect of continued international growth and a multiple rerating offers the potential for outsized returns.

Executive summary

Somero Enterprises, Inc. is a US industrial company, manufacturing equipment for concrete levelling, contouring, and placing. It has been listed on the Alternative Investment Market (AIM) of the London Stock Exchange since 2006, and currently has a market capitalisation of c.£204m ($249m).

The company pioneered the Laser Screed technology that enables efficient and precise concrete levelling. The wide range of products developed and sold by Somero allow this technology to be deployed in almost all construction settings, whether this be large scale projects such as warehouses or public infrastructure, small scale residential developments, or high rise buildings.

Many of the technologies the company has developed are protected by patents. They currently have 90 patents either in place or pending, and continue to invest in new product research and development.

The company’s global headquarters is in Fort Myers, Florida, and its main production facility is based in Houghton, Michigan. It also has regional sales and service offices in the UK, India, Australia, and China.

The Houghton facility has been undergoing a $9.5m, 50,000sq.ft. expansion which will increase its production capacity by 35%. This was on track for completion by year-end 2022, and on budget as of their latest trading update. The expansion will facilitate production volume to support $175m in revenue, creating capacity for growth from the $133.3m of revenue generated in 2021 and $138.8m estimated for 2022.

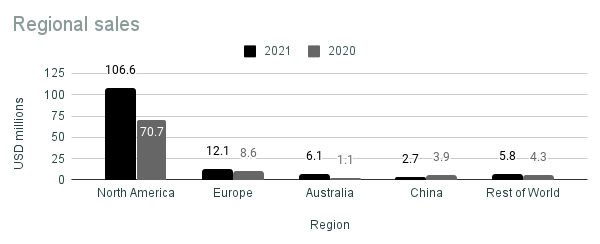

North America is the company’s largest market, making up 80% of sales in 2021. This is followed by Europe at 9.1%, Australia at 4.6%, China at 2.0%, and the rest of the world contributing a combined 4.4%.

Somero’s main customers are concrete contractors, which use its products in a wide-array of construction projects. This has included work for a plethora of the world’s largest organisations, such as: Costco, Wal-Mart, Home Depot, B&Q, IKEA, Coca-Cola, FedEx, and Tesla.

The company has a very robust balance sheet, with a current ratio of 3.79, acid ratio of 3.00, and net cash (after subtracting lease liabilities) of $37.9m at YE 2021.

The average 5-year and 10-year revenue growth figures are 11.72% and 16.96%, respectively. Given the scope for international growth outside the company’s main North American market, I think it’s reasonable to expect revenue growth of around 10% or more to continue.

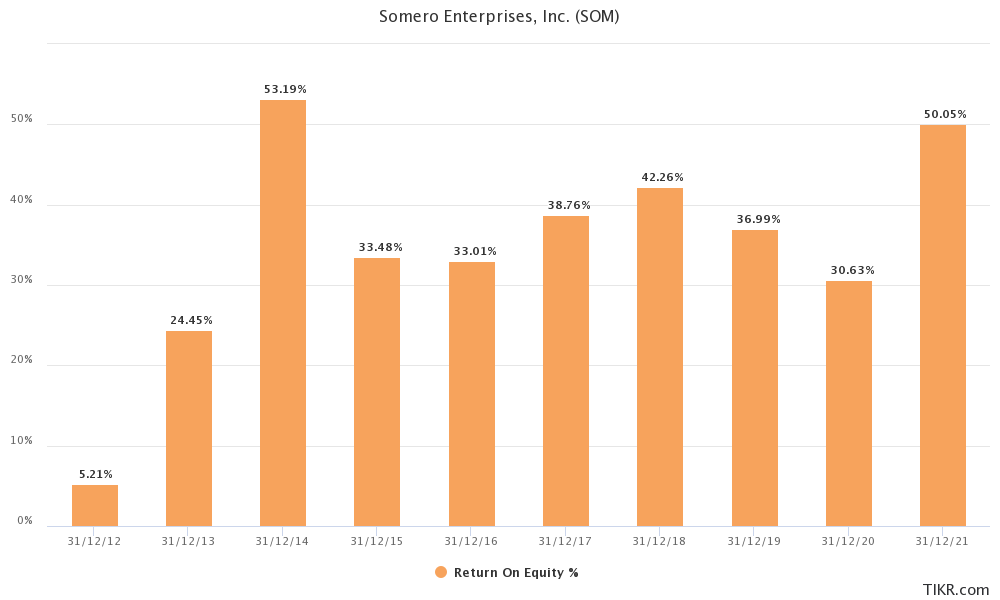

In 2021, the company achieved a pretty phenomenal ROE of 50.1%, and the average of the last 5 and 10 years has been 39.7% and 34.8%, respectively.

Using the results from 2021, the P/E, P/OCF, and P/FCF ratios are 7.1, 6.7, and 8.1, respectively. If we were to use the 5-year average figures instead, the P/E, P/OCF, and P/FCF ratios are 10.9, 9.6, and 10.9, respectively.

In terms of capital returns, the primary medium is through dividends. Overall, dividends paid in 2022 totalled 51.72 cents, equating to a yield of c.11.6% on a stock price of £3.70 ($4.46).

If the company is able to keep growing earnings at somewhere between 5% and 10% a year from their current level, you could be looking at an internal rate of return (IRR) in the range of 15% to 20% when calculated over a 20-year period. This focuses purely on the fundamentals, and doesn’t factor in any potential rerating that could occur somewhere along the way, giving shareholders capital gains in excess of this range.

Company overview

Somero Enterprises, Inc. is a US industrial company, manufacturing equipment for concrete levelling, contouring, and placing. It has been listed on the Alternative Investment Market (AIM) of the London Stock Exchange since 2006, and currently has 55.8m shares outstanding, trading for a combined market capitalisation of c.£204m. Their history is encapsulated concisely in this excerpt from the AIM admission document:

“Somero was founded by members of the Somero family in 1986, the year in which it introduced the first model of the Laser Screed. In 1997, Summit Partners invested in Somero and brought in a new management team led by Somero’s current President and Chief Executive Officer, Mr. John T. (Jack) Cooney. Somero was subsequently sold to Dover Corporation in 1999. In 2005, an affiliate of The Gores Group, a private equity company based in Los Angeles, California, acquired Somero from Dover Corporation.”

It should be noted that Jack Cooney stepped down as President of the company in 2021, but remains CEO. We’ll cover the management in more detail later on.

Products

The company pioneered the Laser Screed technology that enables efficient and precise concrete levelling. The wide range of products developed and sold by Somero allow this technology to be deployed in almost all construction settings, whether this be large scale projects such as warehouses or public infrastructure, small scale residential developments, or high rise buildings.

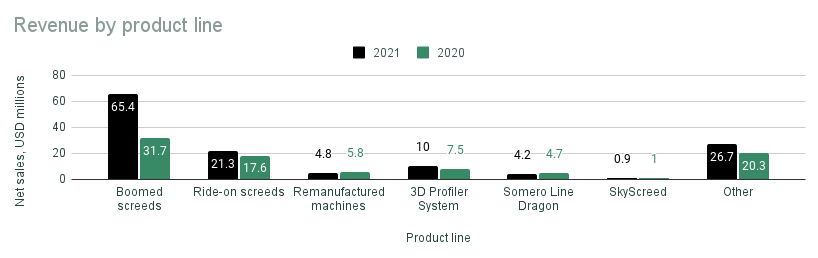

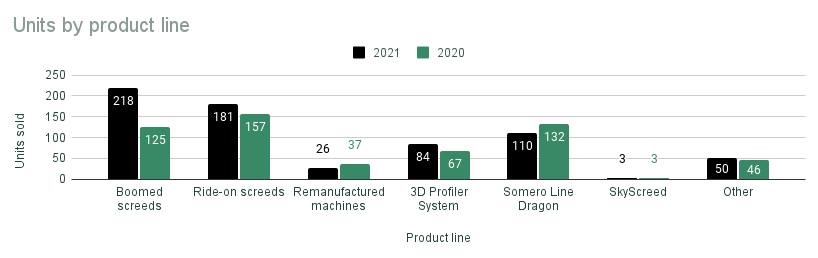

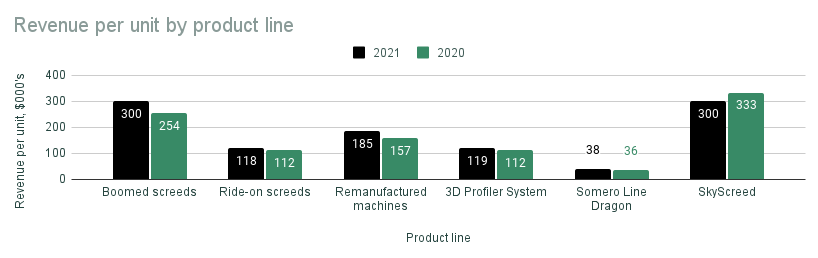

As illustrated in the first chart below, boomed and ride-on screeds are the company’s largest revenue generators, with boomed screeds standing out by a wide margin.

In terms of units sold, the picture is a little more balanced across product lines; boomed and ride-on screeds, and Somero Line Dragon unit volumes are all comparable.

Much of the difference in revenue is explained by the third chart, which shows the average revenue per unit by product line. The substantially higher value per unit of the boomed screeds widens the gap in revenue vs units sold.

Many of the product lines are complementary to each other. For example, the 3D Profiler System can be combined with most of the Laser Screed models to allow accurate paving of contoured surfaces. Similarly, the Somero Line Dragon - a product acquired in 2019 - can be combined with smaller Laser Screed models for rapid and precise concrete placing and levelling. A newly released product - Broom + Cure - is also designed to work in concert with the boomed screed models to brush and cure the concrete immediately after it has been levelled.

As you would expect, many of the technologies the company has developed are protected by patents. They currently have 90 patents either in place or pending, and continue to invest in new product research and development.

Geographic distribution

The company’s global headquarters is in Fort Myers, Florida, and its main production facility is based in Houghton, Michigan. It also has regional sales and service offices in the UK, India, Australia, and China.

The Houghton facility has been undergoing a $9.5m, 50,000sq.ft. expansion which will increase its production capacity by 35%. This was on track for completion by year-end 2022, and on budget as of their latest trading update. The expansion will facilitate production volume to support $175m in revenue, creating capacity for growth from the $133.3m of revenue generated in 2021 and $138.8m estimated for 2022.

North America is the company’s largest market, making up 80% of sales in 2021. This is followed by Europe at 9.1%, Australia at 4.6%, China at 2.0%, and the rest of the world contributing a combined 4.4%.

The European and Australian sales and service offices were established fairly recently, with the European office the older of the two. The investment made in these regional sales and service teams is starting to show in the revenue growth, with Australian growth particularly standing out, though from a lower base.

Due to a lack of demand for its products in China, the company is scaling back its operations there, meaning sales in the country are unlikely to grow in the near to medium term.

Customers

Somero’s main customers are concrete contractors, which use its products in a wide-array of construction projects. This has included work for a plethora of the world’s largest organisations, such as: Costco, Wal-Mart, Home Depot, B&Q, IKEA, Coca-Cola, FedEx, and Tesla.

The company endeavours to build up long-standing customer relationships, which leads to repeat business and ongoing revenue from after-sales services like product training and servicing/repair. It also remanufactures (refurbishes) older machines, which it resells to more financially constrained customers at lower prices than the new models.

Due to the size of some of Somero’s customers, there is an element of concentration to revenues in any given period. For example, at 31 Dec 2021, the company had two customers which represented 21% of total accounts receivable. Similarly, at 30 June 2022, the company had two customers which represented 20% of total accounts receivable. Geographic expansion is likely to reduce this concentration going forward.

Competition and moat

Somero is the largest and oldest manufacturer of laser screed levelling machines, having pioneered the technology in 1986. Its closest competitor is Ligchine, another US company founded in 2007, which offers a range of boomed screed machines with their own laser guided technology. They also make one drive-in model, which is comparable to the ride-on range from Somero, and a concrete placement machine which is a competitor to the Somero Line Dragon.

In terms of scale, Ligchine has a much smaller product offering than Somero, illustrated by the 6 patents it has in place and 8 pending, compared to Somero’s 90. I have found a UK based concrete contractor which uses a Ligchine boomed screed alongside a range of boomed and ride-on models from Somero. This demonstrates that they also have an international presence and can compete with Somero in certain product categories. In this case it was a mid-sized remote controlled machine, which is not something Somero currently offers.

The other competitor I’ve found is Hiking Laser Screed, a Chinese company that makes a range of ride-on and walk-behind laser screed machines in the $20k-$50k price bracket. As far as I can tell they predominantly sell their products in China, and were possibly a contributing factor to the lack of demand for Somero’s products in the country.

I don’t see them as a major competitor to Somero at this time due to their product offering being entirely at the lower-end of Somero’s range and the lack of international presence. It also appears that much of the technology is not proprietary, and they import a lot of the key components from manufacturers in Germany and other countries, so I don’t think they can compete with Somero from a technical standpoint. However, their factory footprint is significant and would likely facilitate substantial sales growth in the future.

Somero’s proprietary technology and commitment to continued R&D, along with its long-standing relationships with major concrete contractors and international scale provide it with a substantial moat and large margins. The risk is that the profitability of the business will attract more competition to the market that will subsequently shrink the company’s margins. Given the competitive advantages of the company and its relatively small market capitalisation, I see it as more likely that a larger company would acquire Somero rather than try to compete directly.

Ownership

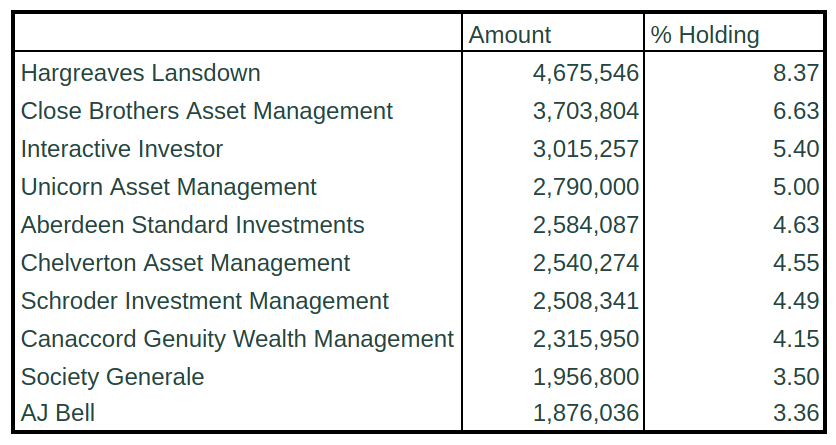

There is no controlling shareholder with majority ownership of the company, and the top 10 largest positions are all comfortably below 10% as shown in the table below. In terms of internal ownership, the largest shareholder by far is the company CEO Jack Cooney, who holds c.1%.

I could be wrong, but I believe the stock brokers listed (Hargreaves Lansdown, Interactive Investor, and AJ Bell) actually represent the conglomeration of individual investor accounts.

Capital allocation

The company executive team strikes a healthy balance between investing for the growth of the business and returning capital to shareholders. Examples of investments made include: the $9.5m expansion of the Houghton production facility; the establishment and buildout of the in-country sales and service teams in an increasing number of geographies; and the acquisition of the business assets of Line Dragon, LLC.

In terms of capital returns, the primary medium is through dividends. The company pays regular final and interim dividends, which most recently came to 22.02 cents and 10 cents per share, respectively. In addition, the company has started paying a supplementary dividend which amounted to 19.70 cents for FY 2021.

The supplementary dividend is set according to a policy of paying 50% of the excess of net cash over the year-end target. In 2021 this target was $20m, but for 2022 it will be raised to $25m to reflect the growth of the business.

Overall, dividends paid in 2022 totalled 51.72 cents, equating to a yield of c.11.6% on a stock price of £3.70 ($4.46).

In addition to dividends, the company also does share buybacks. Currently these are just being used to offset stock based compensation and prevent shareholder dilution. Stock based compensation is currently running at around 1 to 2% a year, so a similar quantity of shares is being repurchased on an annual basis.

Balance sheet

The company has a very robust balance sheet, with a current ratio of 3.79, acid ratio of 3.00, and net cash (after subtracting lease liabilities) of $37.9m at YE 2021 - the last audited financial statements. These figures decreased somewhat in H1 2022 to 3.22, 2.13, and $23.4m, respectively, following the payment of dividends and an increase in inventory.

As of YE 2021, Somero’s current assets made up the majority of its total assets ($68.1m of $97.4m) and most of this was cash and cash equivalents ($42.1m). Inventories made up a further $14.3m and receivables $7.7m. At the end of H1 2022, cash and cash equivalents had fallen to $27.2m following the dividend payment made in May; receivables had been reduced to $6.6m owing to prompt customer payment; and inventory had increased substantially to $19.9m.

The majority of the company’s non-current assets are made up of tangible assets within the category of property, plant and equipment (PP&E). At YE 2021, PP&E was valued at $21.6m and at 30 June 2022 it had increased to $23.2m after continuing work on the Houghton facility expansion was capitalised.

Intangible assets (intellectual property etc) and goodwill made up only a small portion of the company’s overall assets. At 30 June 2022, they were valued at $1.3m and $3.3m, respectively. The goodwill present on the balance sheet is attributable to the company’s prior sale from Dover Corporation to The Gores Group in 2005, and the later purchase of the Line Dragon LLC business assets in 2019.

On the liability side of things there is a similar picture. Current liabilities make up the vast majority of total liabilities ($18.3m of $21.7m as of 30 June 2022), and of these, accounts payable and accrued expenses were the most significant at $7.4m and $10.4m, respectively.

Somero’s debt interest is more than covered by the interest they receive on their cash deposits, so no need to worry about interest cover. The company has a $10m line of credit with a maturity date of September 2024 and an interest rate of LIBOR + 1.25%, which as yet remains undrawn.

Subtracting the liabilities from the assets gives the shareholder’s equity which was $68.3m as of 30 June 2022. With a market capitalisation of c.$249m, this gives a price to book ratio of 3.6. It’s worth noting that this is calculated using the mid-year equity figure, and given management’s year-end estimate for cash to be $39.9m, we could reasonably expect this P/B ratio to be a little lower.

Income

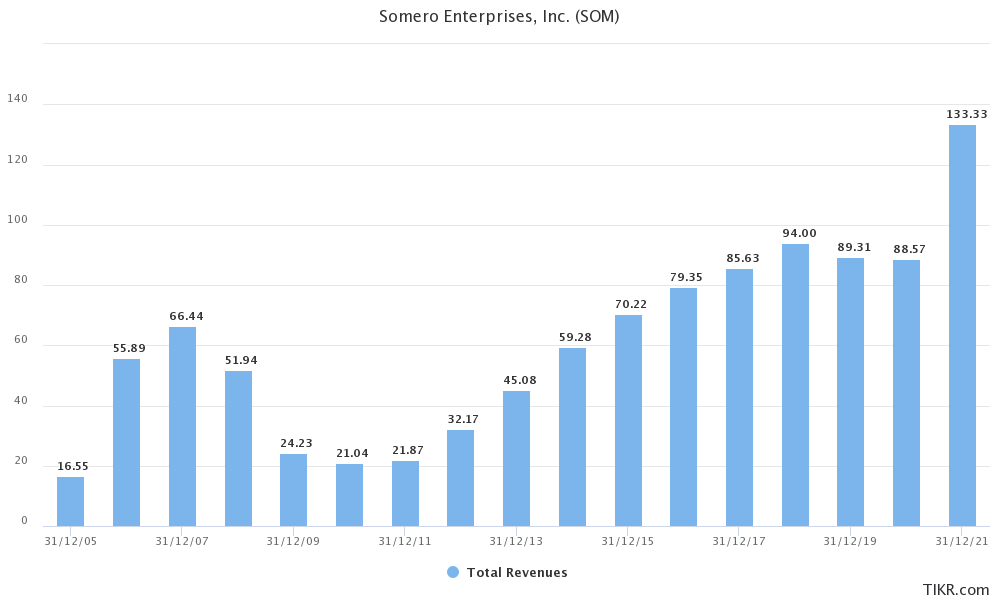

As shown in the chart below, the company’s revenues have grown quite substantially since listing, though with some cyclicality. There was some rapid growth in 2006 and 2007 before the 2008 financial crisis hit and depressed revenues from 2009 to 2011. Then from 2012 to 2018 there was an upward march which cooled off slightly in 2019 and then remained flat in 2020 as we entered the pandemic.

2021 saw a pretty dramatic increase, likely due to pent up demand from 2020 that was pushed back a year, though this appears to be roughly the level you’d expect if 2019 and 2020 had followed the trend of the prior 8 years. Management has estimated that revenues for 2022 will come in at $138.8m, suggesting the high revenue figure in 2021 wasn’t just a one-off spike.

If we include the estimated figure for 2022, the average 5-year and 10-year revenue growth comes in at 11.72% and 16.96%, respectively. Given the scope for international growth outside the company’s main North American market, I think it’s reasonable to expect revenue growth of around 10% or more to continue.

Of course, there is the potential for revenues to take a hit if the economy enters a prolonged recession over the next couple of years. Rapid interest rate rises in response to double-digit inflation in much of the world is likely to have knock-on effects for the global economy that may depress demand for construction, and in turn Somero’s products.

Much of the revenue increase in 2022 was attributable to inflation driven price rises rather than increased sales volumes. In fact, as mentioned earlier, units sold in H1 2022 fell relative to the year before, but we’ll have to wait to see how things went in H2 for a full comparison. I think it would be inaccurate to attribute any slowdown in 2022 sales to general economic stagnation. Rather, it’s more likely to be revenue returning to its previous growth trajectory after the demand carried over from 2020 into 2021 caused a dramatic spike.

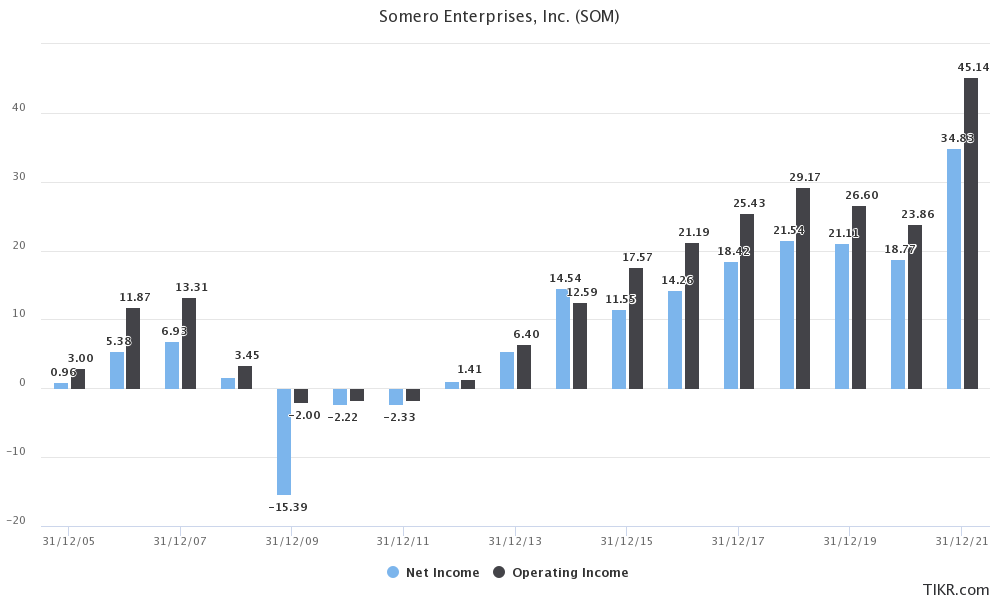

Net income paints a similar picture, though a little less smoothly and with some notable negative figures between 2009 and 2011. The particularly large drop in 2009 was likely due to the write-off of inventory or other assets as a similar fall was not seen in the operating income. I have limited data going back this far, so I’m only able to make an educated guess.

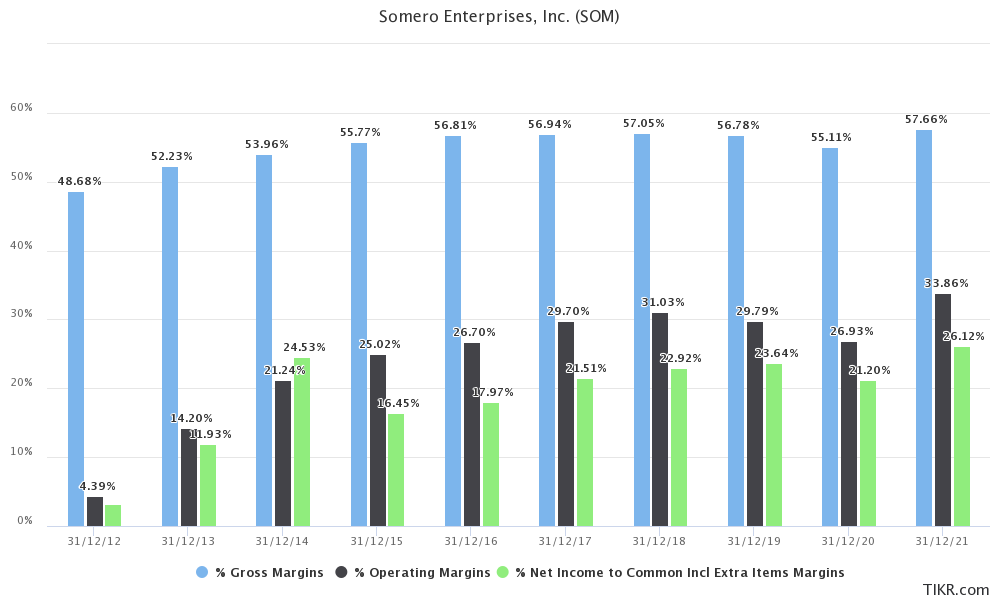

The company has maintained a consistently high gross profit margin over the last decade, averaging 55.1% over this period. The operating profit and net profit margins have shown impressive growth from 4.39% and 3.17%, respectively, in 2012 to 33.86% and 26.12%, respectively, in 2021. The change in these figures indicates a substantial improvement in operational efficiency, which I would attribute largely to operational leverage - operating expenses have grown more slowly than revenues.

The star of the show in terms of metrics has to be return on equity (ROE). Last year the company achieved a pretty phenomenal 50.1%, and the average of the last 5 and 10 years has been 39.7% and 34.8%, respectively. These figures highlight the quality of the business and the competitive advantages it holds in terms of brand and technology.

Cash flows

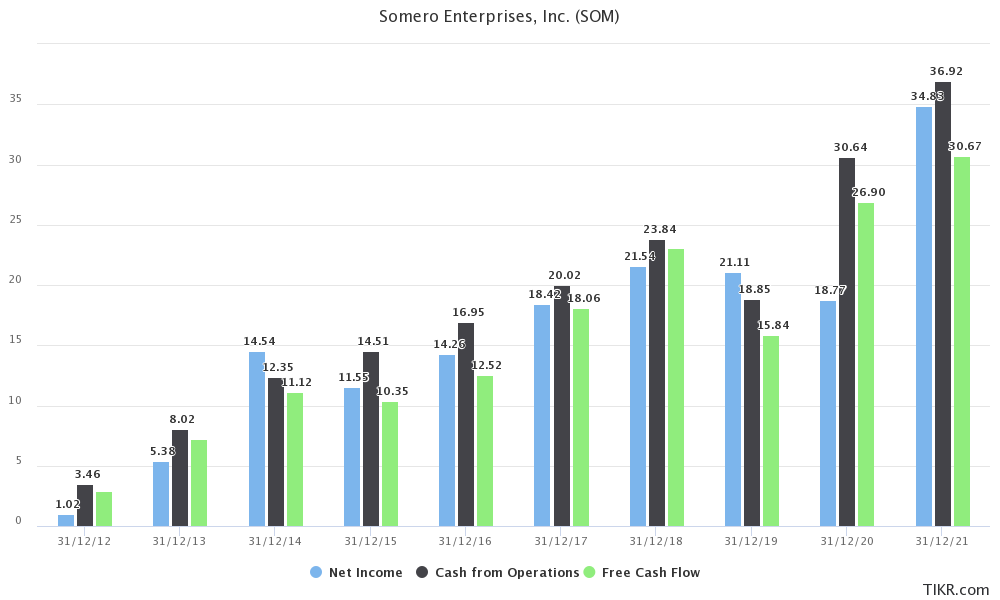

In the year ended 31 December 2021, cash flows from operations came to $36.9m. This was not far from the net profit figure of $34.8m, as positive adjustments for depreciation and amortisation, stock-based compensation, and increased payables balanced negative adjustments for increased inventories, increased receivables, and decreased income taxes payable.

The difference between the two figures in 2020 was much larger, with net profit coming to $18.8m and cash flows from operations $30.6m. The primary reason for this was the positive adjustment for reduced receivables and inventories, and increased payables, without any large negative adjustments to compensate. These are all moves you would expect management to make to maintain liquidity during a period of economic turbulence.

In the results for H1 2022, cash flows from operations decreased to $12.8m from $16.0m in H1 2021. This fall was quite a bit larger than that for the net profit figure (H1 2022: $17.5m, H1 2021: $18.3m) and can be attributed to a number of factors: inventories increased by $5.7m in H1 2022 vs $3.1m in H1 2021; accounts payable, accrued expenses and other liabilities remained largely unchanged in H1 2022, while in H1 2021 they increased by $5.1m. A decrease in receivables of $1.2m in H1 2022 vs an increase of $2.8m in H1 2021 only partially offset the prior two factors.

In 2021, $6.2m was invested in purchases of property and equipment and this trend continued in H1 2022 with a further $2.3m investment. These will both primarily be attributable to the $9.5m being invested in the expansion of the Houghton production facility.

Net cash used in financing activities amounted to $24.3m in 2021, comprising largely of $22.4m in dividend payments and $1.0m in share buybacks. In H1 2022, this had increased to $25.3m owing to the introduction of a supplementary dividend in addition to the final dividend for 2021. We know that a further interim dividend payment was made in H2 2022, amounting to $5.6m. Share buybacks also continued in the second half of the year and the total is expected to be comparable to 2021.

Zooming out to look at the broader picture of cash flows over time, we can see that cash flows from operations have generally moved in line with net profit, and in the majority of years exceeded it, meaning the cash conversion ratio (CCR) has been greater than 1 - the 5 and 10-year CCR averages are 1.16 and 1.40, respectively.

When studying the company’s cash flows from a valuation perspective, the cash flows from operations (with the optional subtraction of depreciation/amortisation charges) are probably the better figure to use rather than free cash flows, which subtract capital expenditure on PP&E, as much of this capex will be attributable to growth rather than replacement.

Management

The company’s Non-Executive Chairman is Lawrence Horsch, age 87. Lawrence has been with the company since 2009, and has served on 26 company boards throughout his career, as well as investing in 30 venture projects and 4 corporate turnarounds. He also co-founded SciMed Life Systems, which was later merged with Boston Scientific Corporation.

CEO and Director John (Jack) Cooney, age 74, has served as CEO of Somero since 1997 and became an executive director in 2005. Prior to joining Somero, he was CEO of Advance Machine Company - a $145m industrial equipment manufacturer located in Minneapolis, Minnesota. I think the performance of the company over Jack’s long tenure speaks to his aptitude as a CEO.

John Yuncza, age 51, joined Somero in 2015 as CFO but has recently taken over the President role from Jack Cooney, and now serves as both company President and Director. Previously, John Yuncza was CFO of Datamax-O’Neil - a subsidiary of Dover Corporation, which we know previously owned Somero.

The current CFO, also serving as Secretary and Director, is Enzo LiCausi, age 48. Enzo joined Somero in 2018 as Vice President of Finance and Controller. He has previously held a number of finance and senior management roles in several well-known companies.

The final member of the executive team is Executive Vice President of Sales and Director Howard Hohmann, age 59. Howard also joined Somero in 1997 and has nearly three decades of experience in the concrete industry. He is an ex-Marine.

The board has a further three non-executive directors, namely: Anne Ellis, Thomas Anderson, and Robert Scheuer.

Valuation and investment case

Given how closely net profit, cash flows from operations, and free cash flows have tracked one another over the last decade, I think it is reasonable to take your pick according to personal preference. To be conservative, I like to use the 5-year average as the denominator in valuation ratios as this allows for a potential downturn in the next few years. Using this approach, the P/E, P/OCF, and P/FCF ratios are 10.9, 9.6, and 10.9, respectively.

Using the results from 2021 rather than the 5-year average, the P/E, P/OCF, and P/FCF ratios are 7.1, 6.7, and 8.1, respectively. I feel these modest multiples combined with the strength of the balance sheet provide adequate downside protection.

To the upside, if the company is able to keep growing earnings at somewhere between 5% and 10% a year from their current level, you could be looking at an internal rate of return (IRR) in the range of 15% to 20% when calculated over a 20-year period. This focuses purely on the fundamentals, and doesn’t factor in any potential rerating that could occur somewhere along the way, giving shareholders capital gains in excess of this range.

At risk of making macroeconomic predictions, it is perhaps worth mentioning that the increased infrastructure spending being proposed by many governments around the world and particularly the US, would be likely to serve as a tailwind to Somero. Concrete will serve as a crucial component of many infrastructure projects, and in most cases it needs to be levelled. Forecasting aside, the management of Somero has stated that many of its customers have significant project backlogs, which provides some visibility for revenues in the coming year.

I don’t think it’s particularly constructive to be too precise with a discounted cash flow (DCF) analysis, as accurately predicting growth rates is highly improbable, and it’s easy to convince oneself that any investment is attractive with the right input parameters. Instead, it’s better to position ourselves with plenty of margin of safety and the scope for substantial gains if the stars align. I feel Somero offers both these attributes at the current price of £3.70 ($4.46) per share.

Risks

The two primary risks Somero faces are a fall in demand due to an economic downturn, and increased competition. I will address both in turn.

The company has been around since 1986 and has been publicly listed since 2006, which means it has survived several recessions of which the most pertinent was the global financial crisis (GFC) of 2008. In the financial data we studied earlier, we saw that revenues took a substantial hit in the years following the GFC, and net income turned negative for three years.

There are a couple of notable points to be made here. Firstly, cash flows from operations remained positive in all years but 2009, where they were ($1.2m). Secondly, the company had a net debt position entering the crisis and was forced to refinance this debt while the financial sector was decidedly risk-off.

On this second point, this is far from the position the company is in today. It has a substantial net cash position and no debt at all if you exclude lease liabilities. In addition, it has a $10m prearranged debt facility in place should it need to draw on it in a crisis of liquidity. These factors, combined with the increased scale of the company and growing presence in international markets make it more resilient to a downturn than it was in 2008. I would consider it highly probable the company could survive even a recession of GFC magnitude.

Addressing the matter of competition, as I’ve discussed previously there are already a couple of competitors in this space. Currently, neither have the scale or product range to match Somero, but this doesn’t mean they couldn’t in the future. Somero will need to continue to grow and innovate in order to stay ahead of its competitors and prevent it losing market share. Thus far, the management has proven their willingness to do so in a measured way that maintains the financial resilience of the company.

This process is likely to prove beneficial to shareholders and customers alike, as the product offering and cash flows of the company will both be improved.

Something that could also be considered a risk is the possibility of the company being acquired. As briefly mentioned above, the company’s competitive advantages and relatively small size from a market capitalisation perspective, make it likely that any large company wishing to enter the sector may consider an acquisition the easier option, when compared to building a competing business from scratch.

Some may see this as an attractive possibility as it would likely result in a quick gain, but for someone looking to hold the business for a long time and benefit from its potential growth, this wouldn’t be a desirable outcome.

Conclusion

As stated at the top, the size of this highly profitable and growing US industrial company makes it too small for many institutional investors, which in turn creates an attractive opportunity for individuals. Adequate margin of safety is provided by a robust balance sheet, with net cash, and a P/E of 7.1. The prospect of continued international growth and a multiple rerating offers the potential for outsized returns.