tinyBuild equity raise

tinyBuild has sent out a circular with the details of the equity raise. Regrettably, it looks like the dilution is going to be around 50%.

On Thursday (21 Dec), the company sent out an RNS notification explaining the proposed structure of the equity raise. There are three principal parts:

- A conditional private placement in which Atari (Atari, SA) will commit US$2m for 31,416,902 shares at a price of 5p per share.

- A conditional placing, open only to institutional investors and underwritten by Alex (the CEO), for up to 157,080,000 shares at a price of 5p per share raising a total of US$10m.

- An open offer to Qualifying Stockholders for up to 33,979,706 shares at a price of 5p per share, raising US$2.16m if fully subscribed. In this offer, each shareholder is entitled to purchase 1 share for every 6 they own at a minimum, and can request additional shares in excess of this amount subject to availability (i.e. if other people don't subscribe to their minimum entitlement). Alex can only participate in this offer if it is not fully subscribed, and to the extent that his maximum subscription (including the placing) does not exceed $10m.

In addition to the above, Alex has a special "Subscription Agreement" wherein his shareholding cannot fall below 37.8% (his current ownership stake) after dilution. In effect this means he is entitled to subscribe to a sufficient number of the shares issued in the placing to maintain his ownership at 37.8%.

In a scenario where all three components of the fundraise were fully subscribed, 222,476,608 new shares would be issued, meaning any existing shareholder who is unable or unwilling to participate in the open offer would incur dilution of 52.18% (using the currently issued share count of 203,878,238 shares). Put another way, their shares would confer ownership over less than half as much of the company as they did prior to the equity raise.

It's worth pausing at this point to say that all of the above requires a shareholder vote on several resolutions to be held at a special meeting on 18 January 2024, and quite a substantial majority is required as I'll detail later on.

Following the first announcement, Berenberg commenced an accelerated bookbuilding process to find institutional investors willing to participate in the placing. It's important to note that this included institutional investors already on the shareholder register, so they had an additional privilege over retail shareholders in accessing a much greater portion of the available shares should they wish to offset their dilution.

As it happens it all came to naught, as later that day when the results of the placing were published, we found out that only 4m of the available placing shares had been subscribed, leaving Alex to pick up the remaining 153,080,000. Depending on take-up of the open offer, Alex will be able to subscribe for an additional 4m shares from there, in line with his commitment to underwrite $10m.

This will mean his subsequent ownership of the company will be between 54.47% and 59.66%, depending on the open offer take-up. So in any eventuality he will now become majority owner.

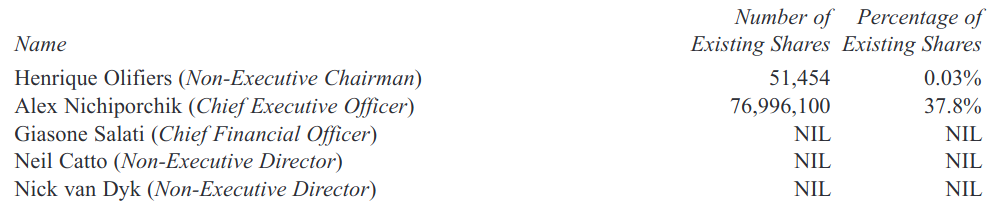

The following day (22 Dec), the Company sent out a 64 page circular detailing the terms of the open offer and the resolutions they wish to pass at the special meeting. I would encourage all shareholders to read this document and not just rely on what I've written here when making your own judgement. Do factor in though that these are the ownership stakes of the Directors making the recommendations:

Astonishingly, I own more shares than any Director except Alex (who is obviously participating in the equity raise), and not one has bought any as the price has fallen. I don't think I can say this of any other company in my portfolio.

The Resolutions

Two resolutions have been tabled, entitled the "Disapplication Resolution" and the "Whitewash Resolution", respectively. You can find their full details on pages 59 and 60 of the circular.

The Disapplication Resolution allows the Company to issue up to 222,481,119 shares at a price of 5 pence per share, in connection with the fundraise. It also requires that shareholders waive their Right of First Offer with respect to the issuance of new shares in this case. In order to pass, 75% of the voting power present in person or represented by proxy at the meeting must vote in favour.

The Whitewash Resolution allows Alex to increase his ownership percentage in connection with the fundraise, without making a takeover offer for the whole company. This will require 50% of the voting power (excluding Alex) present at the meeting to vote in favour.

Management's perspective

The above paints a pretty bleak picture, so I thought it would be beneficial to try and put ourselves inside the heads of management, factoring in the discussions I've had with them (one of which took place on Thu, 21 Dec).

It's possible that Alex would prefer not to pay the full $10m - which to be honest is fair enough - and so they'll have wanted to get participation from other investors if at all possible.

They start testing the waters and get some unexpected interest from multiple strategic partners. These strategic partners obviously want to get the lowest price they can, and Atari is the only one prepared to go as high as 5p per share.

With a strategic partner in place, they think they'll be able to attract some institutional money in the bookbuild. They also estimate (probably correctly) that retail participation will be low, and the 33,979,706 shares allotted will be ample for anyone who wishes to offset the dilution, to do so.

They've subsequently discovered that there isn't any institutional interest beyond the aforementioned strategic partner, so Alex will be providing most if not all of the $10m underwritten.

In my recent conversation, I asked them two pertinent questions which I think most shareholders would like answered. The first was what happened to "we can cut development spending to zero if necessary" as stated in their last earnings call?

Their answer was that they've already made significant cuts, including the closure of two development studios, and to go further would require cancelling games scheduled for release in 2024 that have a high probability of being profitable, and have already incurred millions of dollars in expenses, that would be written-off if they weren't released.

I asked them directly whether these pipeline games that the equity raise is effectively preserving are worth 52% of the company? They said they've run the numbers and do indeed believe the growth in the pipeline is worth more than the rest of the company.

To get their thoughts on the likely consequences of the resolutions not passing, here's an excerpt from the circular:

Should the Fundraise fail to be consummated, the Company could seek other forms of funding, although the Group’s experience of seeking such funds suggests that the terms of such other forms of funding may not be available and/or result in significant value transfer from Stockholders. The Directors believe that [...] such alternative funding may not be available at commercially acceptable terms, or at all, and the Directors would need to balance the receipt of funds with the additional cost of such financing.

In addition to initiatives to provide additional cash headroom, the Company may take action to effect a sale of the business as a whole or the disposals of assets, such as the disposal of one or more of the Company’s businesses or intellectual property. Given the Company’s immediate cash flow requirements, the Directors believe it is challenging to secure a transaction in an acceptable timeframe, and there can be no guarantee that the Directors would be able to secure a transaction at a price which they believe is reflective of the full value of the assets being sold. Such a transaction would restrict the Company’s future growth opportunities and would likely impact the Company’s ability to maintain or improve its competitive positioning.

As a result, if the Fundraise does not proceed to completion and the Company is unable to implement any of the alternative financing arrangements or other actions set out above, the Company would be likely to enter into US Chapter 11 insolvency proceedings. The point at which the Company would have to enter into US Chapter 11 insolvency proceedings is fundamentally uncertain but would likely arise in January 2024, at which point Stockholders would lose all or a significant part of the value of their investment in the Company.

And finally, here's their reasoning for not doing a standard rights issue in which all shareholders would have had equal rights to participate:

Had the Company made a fully pre-emptive offer, for example by way of a rights issue or an uncapped open offer which might have allowed existing Stockholders to subscribe for a larger amount of the overall capital raise, this would have necessitated significant additional cost, re-allocation of management time and a possible delay to the execution of the Company’s plans

Where do I stand?

I lay awake for the whole night on Thursday thinking this over, and have done little else in the days since.

I find it utterly repugnant that retail shareholders are not being treated the same as Alex and the institutional shareholders, despite the fact that we all own the same common shares, that confer equal rights. No excuses will ever change this for me.

Management has taken the gamble of setting the price lower on the (completely useless) advice that they'd be able to attract institutional money, so Alex didn't have to put up the full $10m. This has fairly predictably not happened, and shareholders are being subjected to unnecessarily high dilution for the $2m raised from Atari.

Had they instead followed the proposal myself and several other retail investors put to them, to raise the $10m at 12p per share, Alex would have had a very similar outcome: he'd have likely provided the full $10m, and ended up with 53% ownership. All they've gained from their chosen course of action is an extra $2m in return for 7.5% of the company, and the ire of retail shareholders.

Maybe they should have paid more heed to the advice given freely by investors in the company, than that given by those with no stake or alignment of interests, at a cost of £300k.

Having said all the above, the following may surprise you.

As much as I dislike this deal, I think it is the better of the two options available. Here's my reasoning: should the vote fail to pass (bearing in mind that it's taking place towards the end of January), then short of Alex making an emergency loan, it's very unlikely they'll be able to raise any funding before the cash runs out. This means a takeover, insolvency, stripping for parts, or any number of undesirable courses of action that are entirely out of our control, and unlikely to yield more than the c.£20m valuation implied by the equity raise.

I also believe that there is a high probability the games in the pipeline will be commercially successful, and 50% of the cash they and the current portfolio generate in the coming years may well be worth much more than 100% of the declining cash flows from the current portfolio alone.

There's also the human factor. While many investors may strive to be cold, rational, decision makers, the reality of taking a company and stripping it for assets carries a very human cost. Cutting all development spending and just taking the cash flows from the existing portfolio, means firing all the staff - many of which have been displaced by the Russia-Ukraine war. Any kind of insolvency would have the same result absent a complete takeover.

Even Warren Buffet, arguably the world's greatest investor, found he didn't have the stomach for this type of investing when he had some early experience of it during his partnership days. You might be a little further removed from the action, but that doesn't change the reality.

I don't think, as many other people have said, that this is all a scheme for Alex to gain control of the company at a cheap price. The reason being that were the placing and open offer to be fully subscribed, he wouldn't have been able to increase his stake at all. In my mind, the course taken comes down to a misguided view that they'd be able to get greater institutional participation, and Alex wouldn't need to make such a large contribution.

In any case, I will be voting in favour of the resolutions, as much as it pains me to do so.