Firm Returns Weekly - Newsletter overview, and updates on TMI, WBD, and TBLD

TMI's half-year report and trading update, WBD's podcast deal with Spotify and a strong start for Wonka, and a positive response for Deadside's v0.10.0 update (TBLD).

Newsletter overview

A lot of new people have signed up in the last couple of weeks, so I thought I'd give them a quick intro as to what they can expect, as well as providing an update on how the newsletter is doing in general.

So first off, these Firm Returns Weekly newsletters provide ongoing coverage of the companies I hold in my portfolio, namely: Ecora Resources (ECOR), Warner Bros. Discovery (WBD), tinyBuild (TBLD), Taylor Maritime Investments (TMI), Fuller, Smith & Turner (FSTA), and Aviva (AV).

In addition, you will from time to time see segments on general investing thoughts, and I'll possibly start adding in coverage of companies on my watchlist that I'm actively tracking.

Separately, you'll receive Portfolio Updates when I buy or sell shares, and deeper Stock Analysis on individual companies - admittedly it's been quite a while since I've done a write-up on a new company, but I hope to change this soon.

Firm Returns now has 425 members, and more than 200 people read the newsletter every week - which is incredible!

The open rate for the newsletter consistently exceeds 60%, and can get up into the 70s for new write-ups, or big updates.

Looking back to the end of last year when I was just starting, I thought I might get 100 readers by the end of 2023 if I was lucky, so these numbers really have exceeded my expectations.

I'm going to do my best in 2024 to see if I can grow my regular reader base to 500. If you want to help me, please tell someone else you know who might be interested about Firm Returns. It's the best way to help the newsletter grow and really motivates me to keep writing.

Anyway, let's get onto the main topics for the week.

Taylor Maritime Investments

Half-year report

TMI has published their half-year report for the 6 months ending 30 Sep 2023. There were no big surprises as we've heard most of the key info from the quarterly trading updates, but I pulled out a few points of interest.

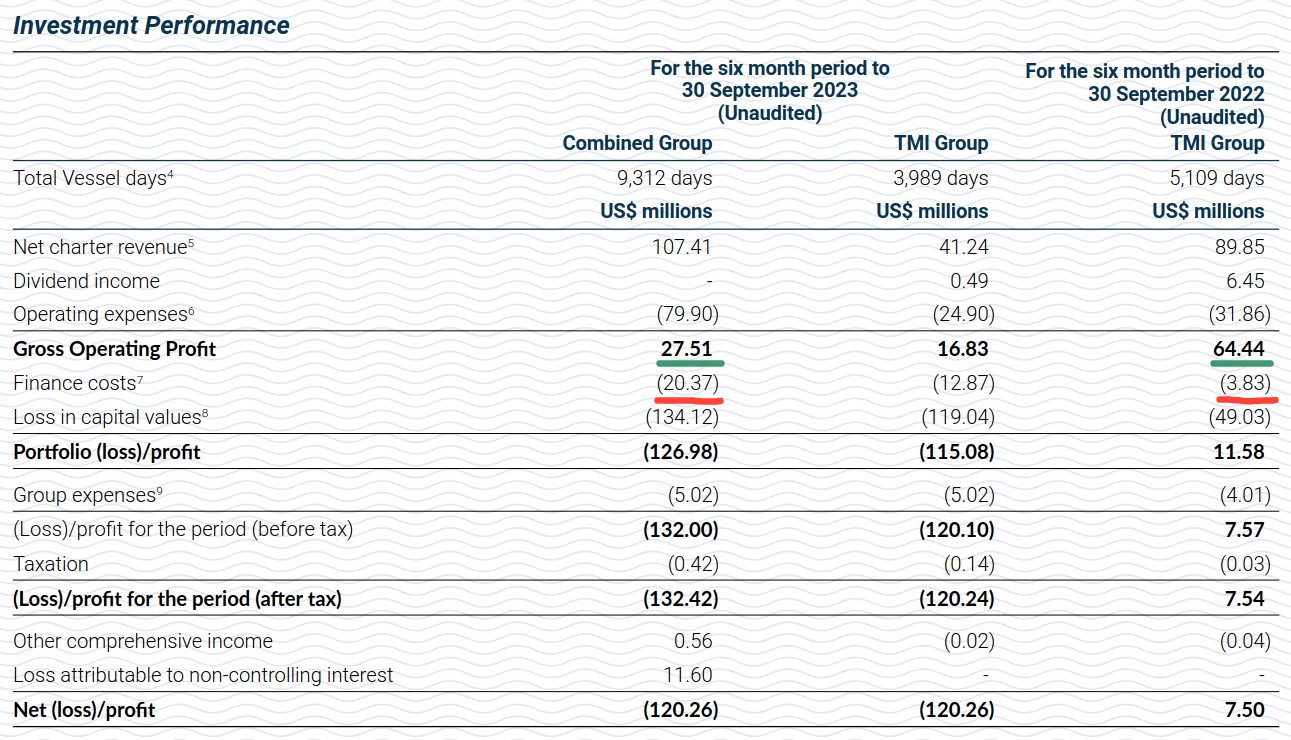

Investment performance

First is the investment performance table show below. As highlighted, gross operating profit has fallen substantially despite a larger combined fleet, reflecting the impact of lower charter rates in the period.

Finance costs have also seen a substantial rise as a result of higher interest rates and the debt taken on to fund the Grindrod acquisition. These costs provide plenty of impetus for deleveraging the company, which management has been doing aggressively.

I'm not too concerned by the "loss in capital values", as this is largely an artefact of timing due to the valuation date falling pretty close to the trough in charter rates. This is likely to have seen some reversal by the time we get the next trading update, in line with the rebound seen in charter rates (more on this later).

It's also just a paper loss until realised through an asset sale, and most of the vessels that have been sold generated returns in excess of their cost bases, even if below their peak valuations.

Debt covenants

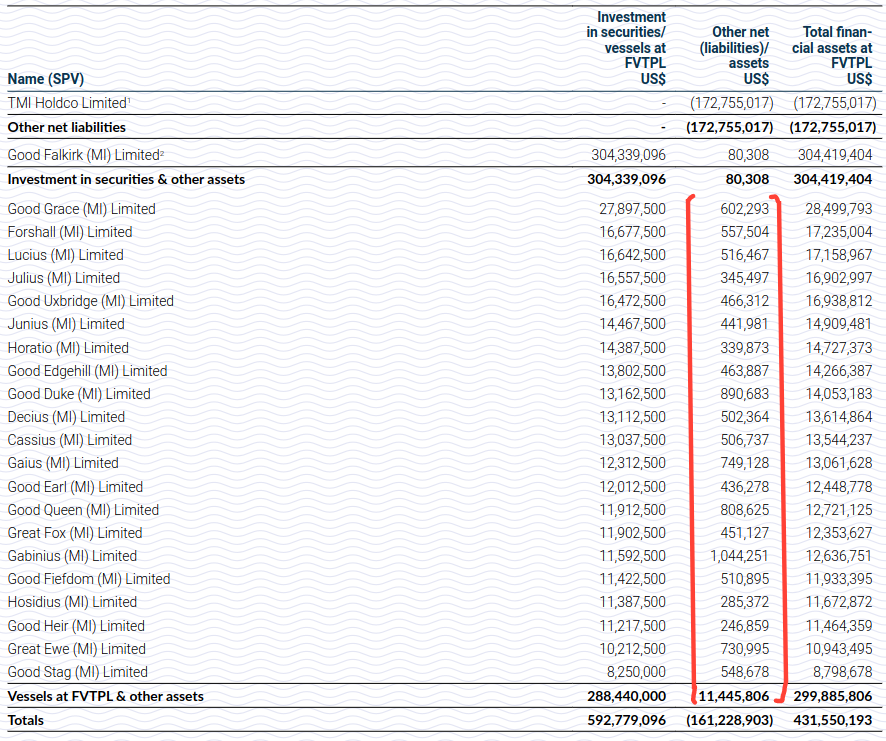

I found an interesting little nugget in the financial covenants on their new debt facility: there is a minimum liquidity requirement for them to hold at least $5m plus an additional $250,000 per vessel owned or bareboat chartered by TMI.

With this info in mind, we can look at the table of assets and liabilities included in the "Additional Information" section of the report, and see that much of the cash required by these covenants is held in the individual SPVs for each vessel.

Dividend cover

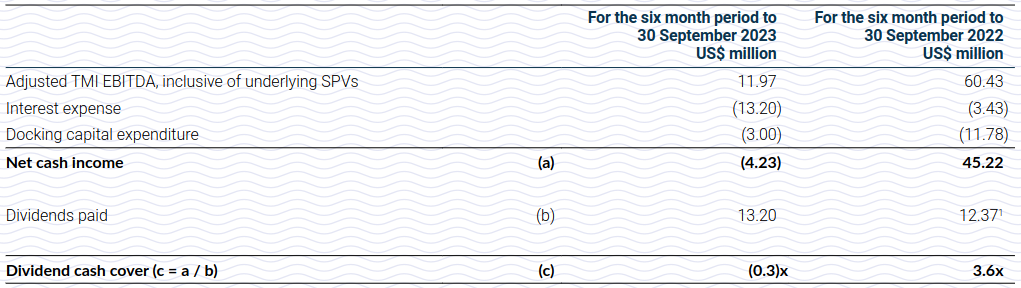

Another good find in the additional information section was the following table detailing the dividend cover calculation.

Here you can see the true cash flow they're generating from operations, as well as the cash cost of debt interest and docking capital expenditure (fleet maintenance expense). They have notably been able to reduce the docking capital expenditure in 23H1 vs 22H1. This could suggest that non-essential work was done the prior year to enhance the fleet, or that they've postponed maintenance expenditure this year.

In any case, we can see that the fleet didn't generate enough cash in the first six months of the financial year to cover the dividend, even excluding interest expense.

I hope these examples show you the importance of reading the notes to the financial statements.

Post-period trading update

The company is starting to lock in some significantly higher charter rates in the last month or so. Here's what they said:

Dry bulk rates accelerated from mid-November before surging at the end of the month with the adjusted BHSI TCA rising to US$12,967 per day and the adjusted BSI TCA rising to US$16,715 which is 121% and 124%, respectively, above their mid-August low points. The Company subsequently agreed medium-term charters for three TMI Handysize vessels; a US$16,000 per day gross time charter rate for 100 to 150 days, a US$19,000 per day gross time charter rate for about 75 days and a US$13,000 per day gross time charter rate for 100 to 150 days.

This is a very welcome development that should allow the company to continue its debt repayment without needing to sell as many vessels, and those it does sell are likely to command higher prices than just a few months ago.

https://www.londonstockexchange.com/news-article/TMIP/half-year-report/16245711

Board changes

We also heard this week that Charles Maltby will be appointed as a Non-Executive Directory of the Company from 1 January 2024. Charles has served on the Board of Grindrod since the 6 December 2022, and will be resigning from this post on 31 December 2023.

Helen Tveitan will also be retiring from the TMI Board on 31 March 2024.

https://www.londonstockexchange.com/news-article/TMIP/board-changes/16247606

Warner Bros. Discovery

Spotify podcast deal

Moving on to some WBD news. We heard this week that they have just signed a podcast deal with Spotfiy. This will include CNN's All There Is with Anderson Cooper, The Assignment with Audie Cornish and HBO's The Official Game of Thrones Podcast: House of the Dragon.

This is in addition to a multi-year deal they have with Spotify to create podcasts from DC Comics.

Wonka

Wonka seems to have got off to a strong start in its US opening weekend (having released a week earlier in some international markets like the UK), with gross revenue of $39m in the US and $151.4m globally. Set against a production budget of $125m, it's looking like this film could turn a tidy profit if it maintains its current trajectory.

-3-News.jpg)

tinyBuild

Deadside update

We're still waiting on news of the equity raise, but in the meantime I wanted to share a positive update on Deadside.

On Thursday (14 Dec), the developers released v0.10.0 which includes a major map expansion with a large new city, along with notable improvements to game performance and AI.

The update has generated a lot of engagement, with peak concurrent player numbers hitting a 12-month peak of 2,218 on Saturday, and there has been a significant jump in positive reviews on the game's Steam store page in the last few days.

I tested the update out with a friend on Friday evening on a server at full capacity (50 players), and can genuinely say I was impressed with what they've done. The new map area is great and really helps the game to feel less crowded when the server is full, and the AI and performance improvements were easily visible.

I think this game continues to have a lot of potential and I look forward to seeing where it goes from here.