TMI Update

This post provides an update on Taylor Maritime Investments (TMI) and the events that have taken place since my initial write-up in May last year. If you're not familiar with the company or want a refresher, take a look at that post first.

The first thing to mention, is that they took the next natural step after acquiring 26% of Grindrod Shipping Holdings Ltd (GRIN), by making a takeover bid that resulted in TMI now owning 83.23% of GRIN. The offer was made entirely in cash and amounted to $26 per share - comprising $21 from TMI and a $5 special dividend paid by GRIN. With a reported ~19m shares in issue, this valued Grindrod at just under $500m, which was a small discount to the estimated NAV of $529m based on fleet valuations from brokers.

Of course, TMI acquired the initial 26% at a lower price than the tender offer made to the remaining shareholders, and the company will also have received the special dividend on its shareholding. These factors will have reduced the average price somewhat, and widened the discount to NAV.

To fund the acquisition, the company used a combination of cash flows from operations and debt. The latter component required a general meeting with shareholders to get their approval for temporarily raising the debt limit from 25% to 40%. In Q4 FY22 (ending 31 Mar 2023), they made significant progress in bringing this down using both cash flows from operations and accretive vessel sales at MOICs of 1.5x-2.0x.

The debt sitting on TMI's balance sheet at quarter end was $222m, representing a debt to gross assets ratio of 27.7% - expected to reduce to c.25% by the end of Q1 FY23 (30 June 2023). The real "look-through" figure, that accounts for the $205m on GRIN's balance sheet, was 38.9% - expected to fall to c.35% by the end of Q1 FY23.

With the addition of Grindrod's assets, the group's fleet at quarter end comprised 54 vessels with a market value just shy of $1bn. Additional vessel sales are planned to accelerate debt repayment while ship prices remain attractive, so we can expect this market value figure to decrease in the near-term. However, paying down the debt with operating cash flows and asset sales above their carrying value will increase the net asset value (NAV) attributable to shareholders, which stood at $567m or $1.72 per share at quarter end. This compares very favourably to the current market capitalisation of ~$375m at a share price of $1.15 - representing a 33.8% discount.

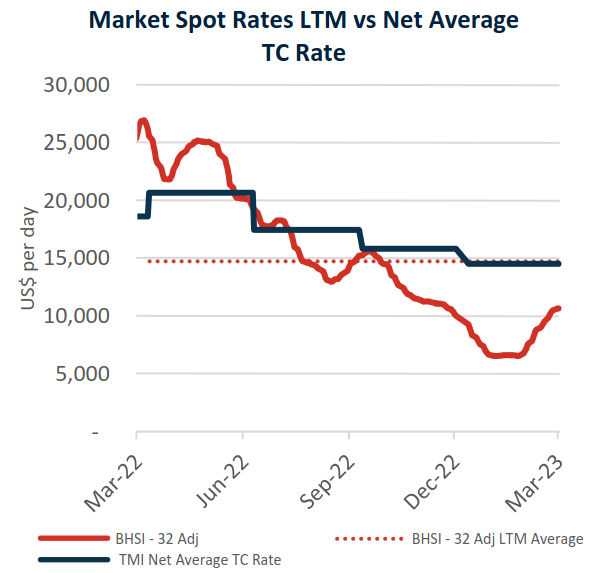

Moving on from the balance sheet to look at the operations, net time charter rates for the company were c.$14,500 per day at quarter end, versus the Baltic Handysize Index (BHSI) average charter rate of $10,331 per day, with an average charter duration of 4 months. This equated to an average annualised unlevered gross cash yield of c.17.5%.

You can see from the graph below how the company's chartering strategy - using a mix of charter durations - has smoothed out oscillations in charter rates and provided better visibility, as intended.

I won't dwell too much on the macro outlook as it's inherently uncertain, but the current forecasts have minor bulk and grain demand growing 2.1% in 2023, and 3.2% in 2024. This is set against the expectation of Handysize fleet growth of 0.4% in 2023 then -1.0% in 2024, and Supramax and Ultramax fleet growth of 2.2% in 2023 then 1.8% in 2024.

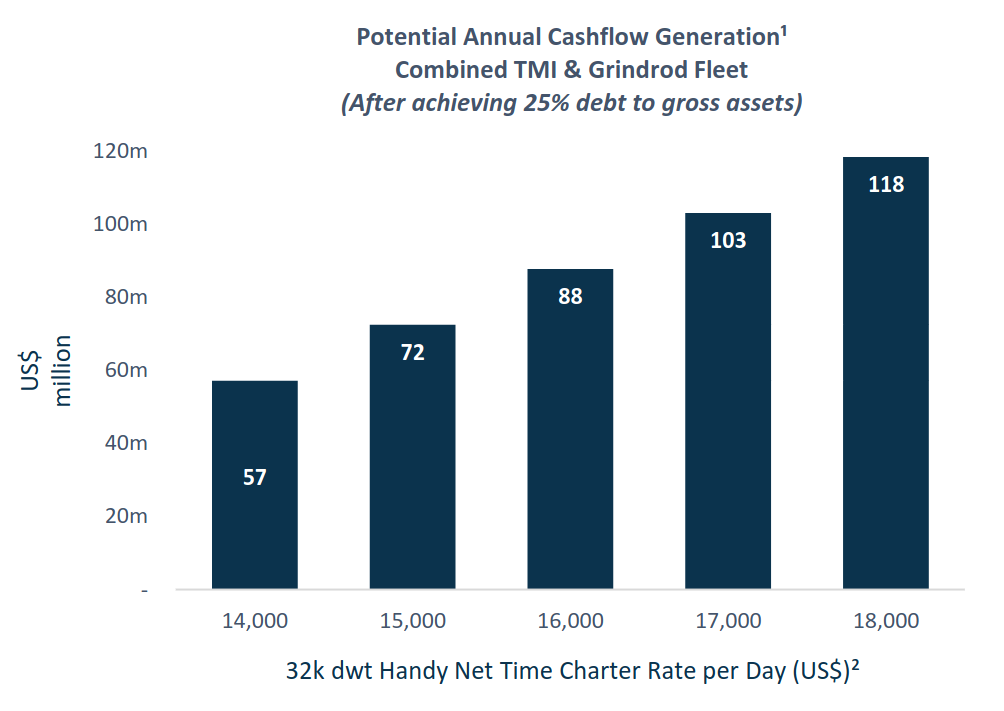

This mismatch between supply and demand is likely to prove positive for charter rates, and thus the company's profits. Management has provided a helpful graph that illustrates the operational leverage of the combined fleet (prior to any synergies), which you can see below. There's a realistic prospect of the company generating operating cash flows in excess of $100m with supportive charter rates.

The management hopes to realise a number of synergies from the combination of the operations TMI and GRIN, and has taken the initial step of merging the two executive teams, with Edward Buttery now serving as dual CEO of both companies.

Next steps will be to merge the commercial management teams and technical management teams, with former benefiting from an enhanced market presence, and the latter from economies of scale and increased purchasing power.

One final thing to mention is that the company is in the process of recruiting a new Chairman, after Nicholas Lykiardopulo resigned following the merger. The reason Nicholas gave for departing was that the increased size of the combined group has made the role of Chairman too large for him to manage alongside his other business commitments - he runs his own family shipping firm.