Firm Returns Weekly - TBLD, ECOR, AV, WBD

tinyBuild

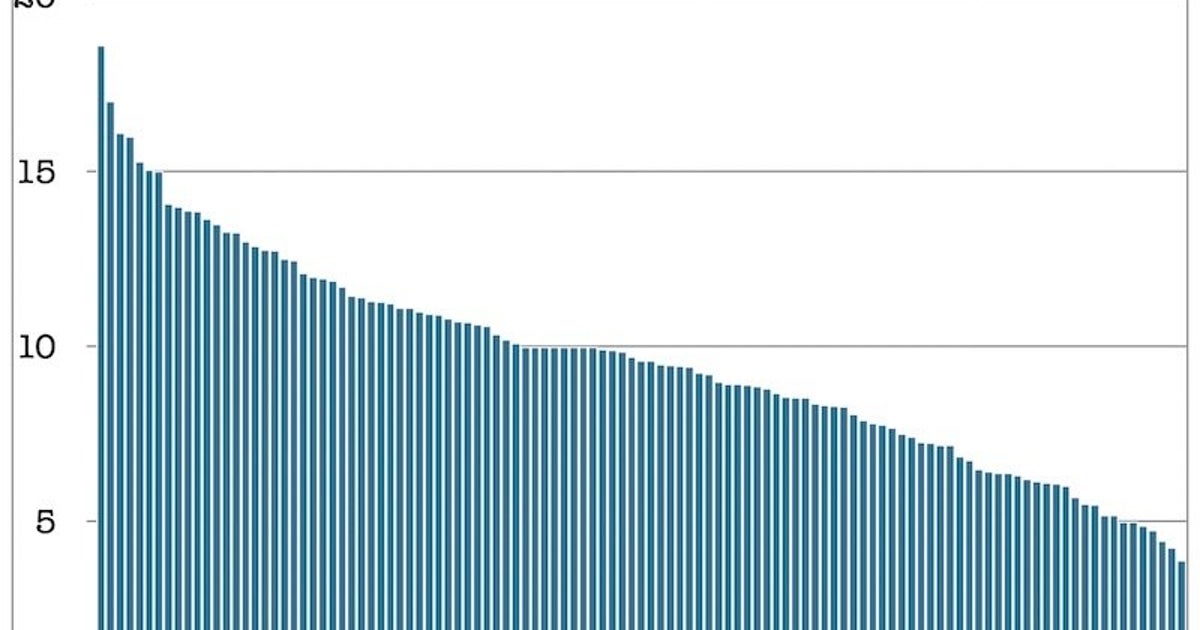

We're expecting tinyBuild's interim results soon, so there should be a fair amount to discuss when they're released. In the meantime, I wanted to share a couple of articles I read this week that could be useful for anyone trying to gauge a game's success from the publicly available data. The stats around follower to wishlist ratios and wishlist to sales conversion was particularly interesting.

Notably, tinyBuild sits at the upper end of performance for many of these metrics.

Ecora Resources

Ecora released their interim results this week, and on the whole they're in line with previous guidance. Here are some highlights:

- Total portfolio contribution was down to $44.5m from $92.8m the prior year, due largely to decreased volumes from Kestrel as production moves out of Ecora's royalty area, and lower coal prices.

- Voisey's Bay also saw a pretty dramatic drop in portfolio contribution ($3.1m vs $13.9m) as volumes decreased by 50%, reflecting the ongoing transition from open pit to underground mining currently underway, and average cobalt prices falling to $16.54/lbs from $37.61/lb in H1 2022.

- H1 2023 Adjusted earnings and FCF were $23.4m and $17.5m, respectively.

- H2 portfolio contribution is guided to be lower than H1, so management is expecting to draw down on their credit facility to cover the near-term shortfall.

- Management emphasises that they still have sufficient liquidity to cover their cash requirements and potentially fund future growth acquisitions.

Aviva

Aviva has announced the appointment of Jason Storah as CEO of UK & Ireland General Insurance, replacing Adam Winslow who is leaving for an external opportunity. Jason is currently CEO of Aviva Canada, which has grown to be the number two general insurer in Canada during his tenure, with the lowest COR across the Group.

Tracy Garrad, who was previously CEO of AXA's UK Healthcare business, will succeed Jason as CEO of Aviva Canada.

Warner Bros. Discovery

WBD has put out some updated guidance for Adjusted EBITDA and FCF in line with the new assumption that the WGA and SAG-AFTRA strikes will continue through the end of 2023.

Adjusted EBITDA is now expected to be in the range $10.5-$11bn, with the negative impact from the strikes amounting to $300-$500m.

The opposite effect is being seen with Free Cash Flow, where guidance has now increased to $1.7bn for Q3 and at least $5bn for the full year.

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001437107/3e191628-0662-48f4-9bcf-c46db56a8c46.pdf