Firm Returns Weekly - WBD, TBLD, FSTA, ECOR, AV

This week's newsletter is a little late because I was travelling to attend a wedding over the weekend, but there's quite a lot to discuss.

Warner Bros. Discovery

Barbie update

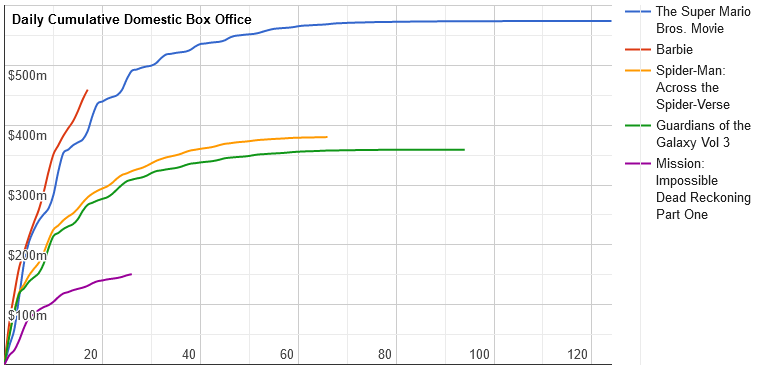

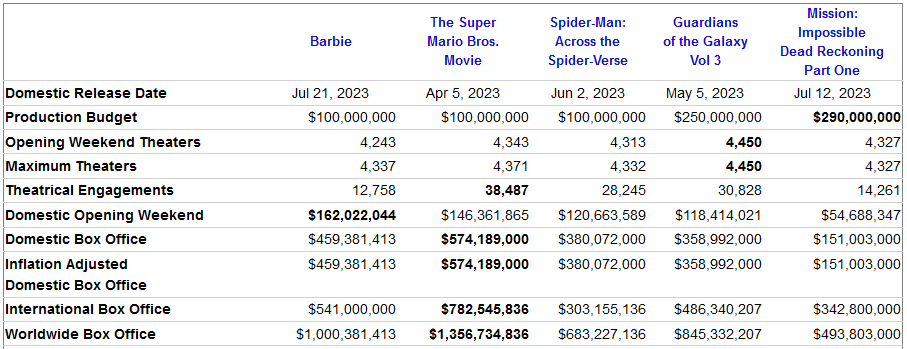

Barbie continues to perform very well, and has now exceeded $1bn in worldwide box office revenue. Its steeper trajectory gives it a good chance of passing The Super Mario Bros. Movie as the most successful film of the year so far.

Meg 2: The Trench

Meg 2: The Trench was released on Friday, and took the number 2 spot behind Barbie over the weekend, with worldwide ticket sales estimated to be $142m.

Q2 earnings

On Thursday WBD released their Q2 earnings, which have lifted the share price >10%. Here are some of my key takeaways:

- The company generated $1.7bn in free cash flow during the quarter and expects to do roughly the same in Q3. FCF for the year is expected to be in the range $4.5-$5bn.

- $1.6bn of debt was repaid in Q2, bringing the total since the merger to $9bn. A further tender for up to $2.7bn has been announced. They remain on track to achieve their targets of below 4x leverage by the end of this year, and 2.5x-3x by the end of 2024. Net leverage was 4.6x at the end of the quarter.

- DTC was pretty well break-even in Q2 and modestly EBITDA positive in H1, despite the increased expenses associated with the launch of Max.

- Churn from the Max launch was lower than expected and they're seeing early signs of increased engagement on the platform. That said, they did see a net subscriber loss of 1.8m during the quarter, largely due to the overlapping subscriber bases between Max and Discovery+. The introduction of live programming (news and sports) is something they're working on currently.

- There were some really interesting insights in the earnings call around how they marketed Barbie across their entire business e.g. Barbie Dreamhouse Challenge on HGTV, and Food Network's Barbie-themed Summer Baking Championship.

- While the ad market is still very challenging, their volumes at the recent upfront are up and price levels remain the same vs the prior year.

- The strikes, while destructive in the long-run, are actually providing meaningful cost savings and boosting the company's FCF in the near-term. An estimated $100m+ was saved in Q2.

tinyBuild

Wishlist ranking

With I Am Future set to release in early access tomorrow, I thought it might be good to provide an update on where some upcoming titles sit in the Steam wishlist rankings compared to when I wrote about them last.

- I Am Future: #135 vs #165.

- Streets of Rogue 2: #130 vs #136

- Level Zero: #318 vs #331

- Sand: #270 vs #287

- Ferocious: #146 vs #146

- Stray Souls: #491 vs #509

- Broken Roads: #170 vs #173

Black Skylands is also leaving early access on 15 Aug, but since it has been available on Steam since 2021, we don't have any wishlist data for it. What I can say is that its following currently sits at 26,212, so it's well positioned for a strong v1.0 launch.

Punch Club 2 article

tinyBuild's CEO has published a very interesting and detailed article on how they planned and executed the launch of Punch Club 2, and how it has performed since. Highly recommend giving it a look:

Fuller, Smith & Turner

We received notification that Lansdowne Partners (a London-based hedge fund with a value focus) had increased their stake from 8.4% to 10% of the A shares outstanding on 1 Aug.

Ecora Resources

Some insider buying by the CEO, CFO, and Chairman of Ecora Resources also occurred on the 31 Jul and 1 Aug.

Aviva

We were also informed today that Close Asset Management Limited has built up a 5.43% position in Aviva. With £15.3bn of assets under management, this 5.43% position - equating to around £550m - represents a meaningful allocation (3.5-4%).

Aviva is due a more thorough update at some point, since a fair amount has happened since I last wrote about the company.

Investment search

I looked through another 50 or so companies this week, and identified the following as potential candidates for further study:

- Globalworth Real Estate Investments (GWI)

- CLS Holdings plc (CLI)

- Marlowe plc (MRL)

- Volex plc (VLX)

- Tullow Oil plc (TLW)

- Kenmare Resources plc (KMR)

- Kier Group plc (KIE)